CEO Comments

Kaoru Hayashi

Representative Director,

President Executive Officer and Group CEO,

Digital Garage, Inc.

Volume 70, 2020.05.13

CEO Comment Vol.70 “FYE March 2020 Financial Report Summary and Digest of New Mid-term Plan”

〜Designing our New Normal Context〜

With the approval of the Board of Directors today, we have announced FY20.3 financial results and our new mid-term plan. The following is a report of the financial summary of FY20.3.

Ⅰ. FYE March 2020 Financial Report Summary

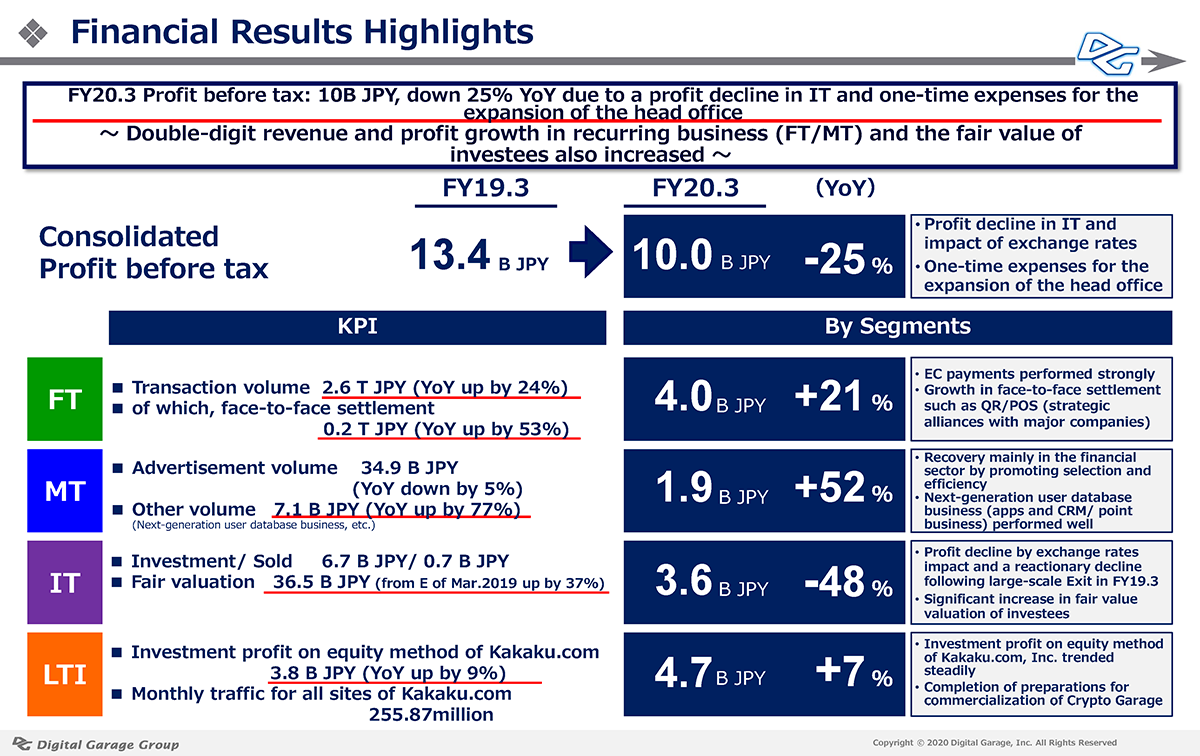

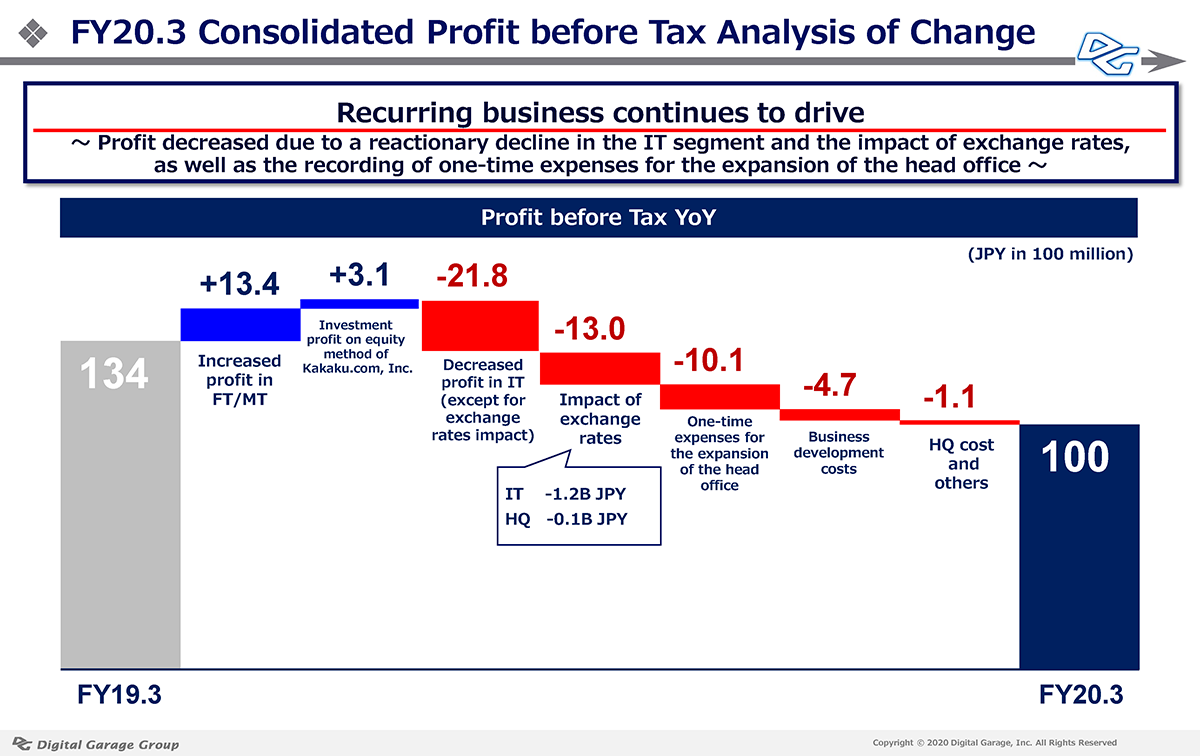

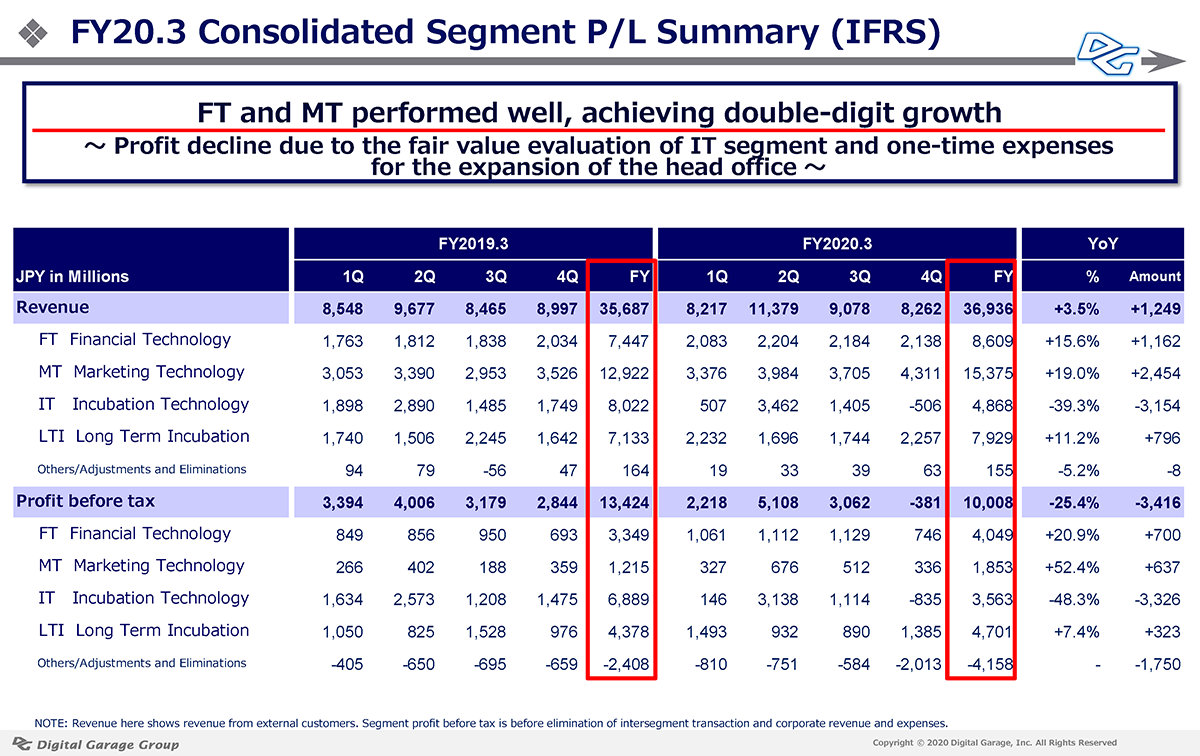

Consolidated revenues for the fiscal year ending March 31, 2020, the second year of IFRS was applicable, amounted to 36,936 million JPY (up 3.5% YoY), and profit before tax amounted to 10,008 million JPY (down 25.4% YoY), and profit attributable to owners of parent amounted to 7,420 million JPY (down by 24.1% YoY). Revenues from the recurring business (Financial Technology Segment and Marketing Technology Segment) increased 17.5% YoY. Meanwhile, Incubation Technology Segment recorded a decrease in profit due to a decline in the fair value valuation gain on stockholdings, a 1.3 billion JPY decrease in foreign currency denominated assets due to the appreciation of the yen, and a 1 billion JPY one-time expense due to the expansion of the head office.

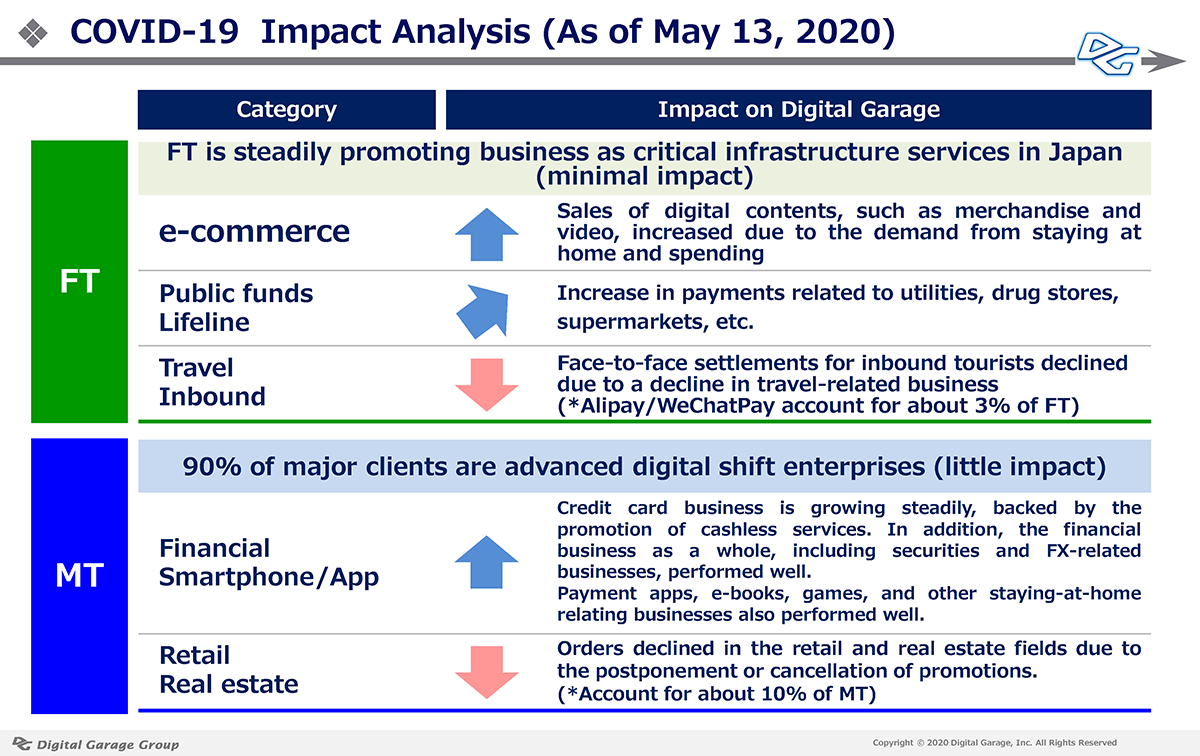

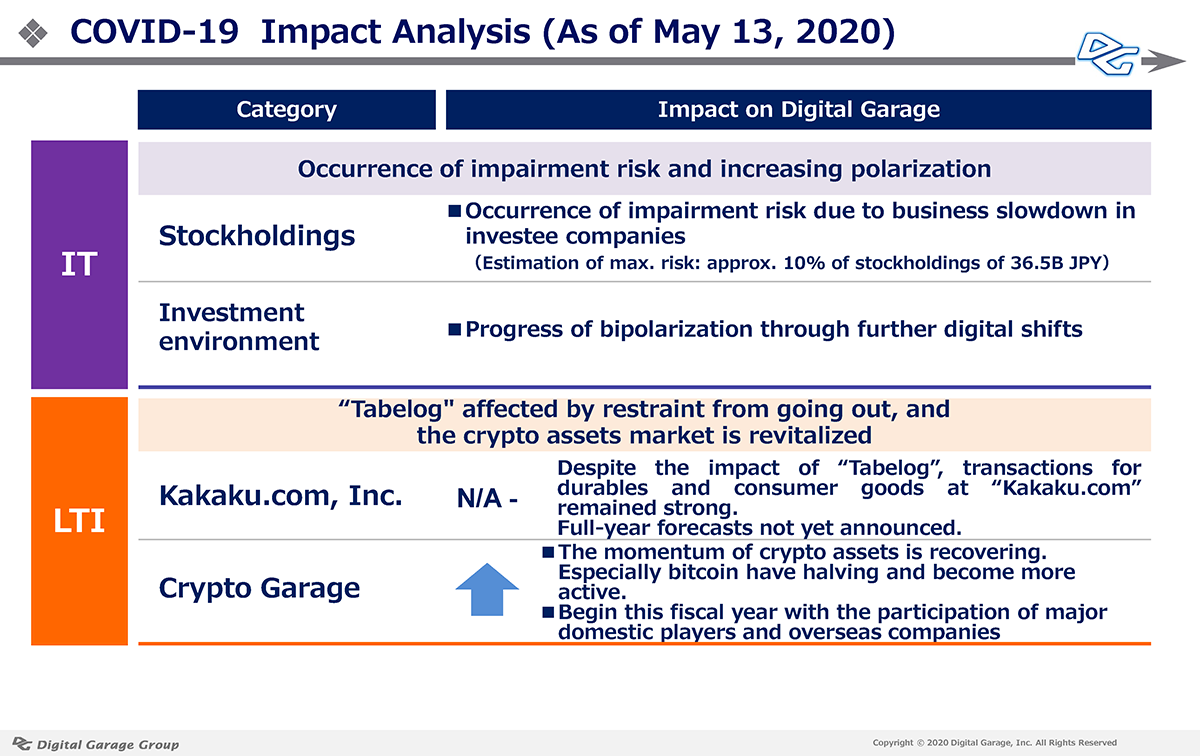

The impact of the COVID-19 on our business was summarized in two slides as follows.

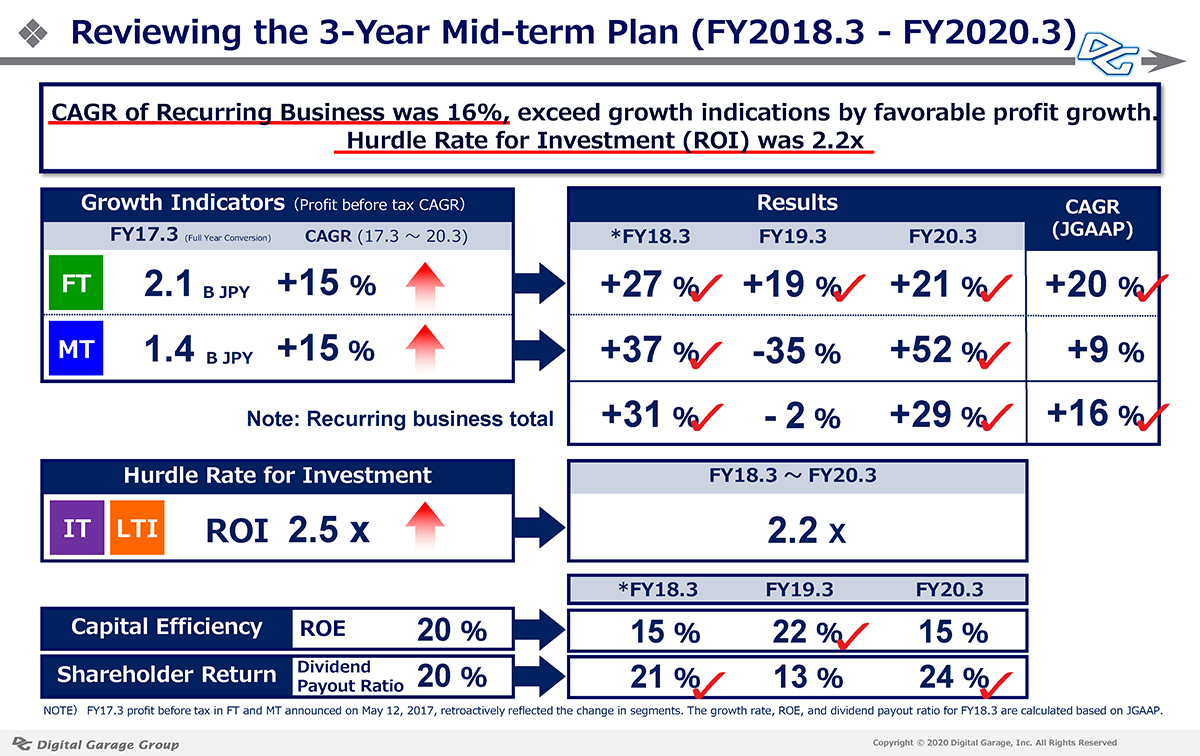

The pandemic of COVID-19 resulted in stock volatility that had never been experienced in the fourth quarter, as well as an emergency declaration that could be said to be a country difficulty. However, as shown in the above slide, collaboration with companies and services, which are already undergoing a digital shift in the FT and MT segments, has had relatively little impact. Looking back over the past three years, the average annual growth rate for the recurring business as a whole exceeded the target at 16%. We believe that the investment hurdle rate was 2.2 times over the three-year period, and that the target for the three-year period from FY3/18 to FY3/20 was almost met.(Please refer to the slide below,“Reviewing the 3-year Mid-term Plan (FY2018.3 – FY2020.3).”) For the new fiscal year, which has already begun, in consideration of the various impacts of COVID-19 at this point, we have set a longer span and formulated a five-year plan this time than the previous mid-term management plan.

An overview of results by business segments for FY20.3 is as follows.

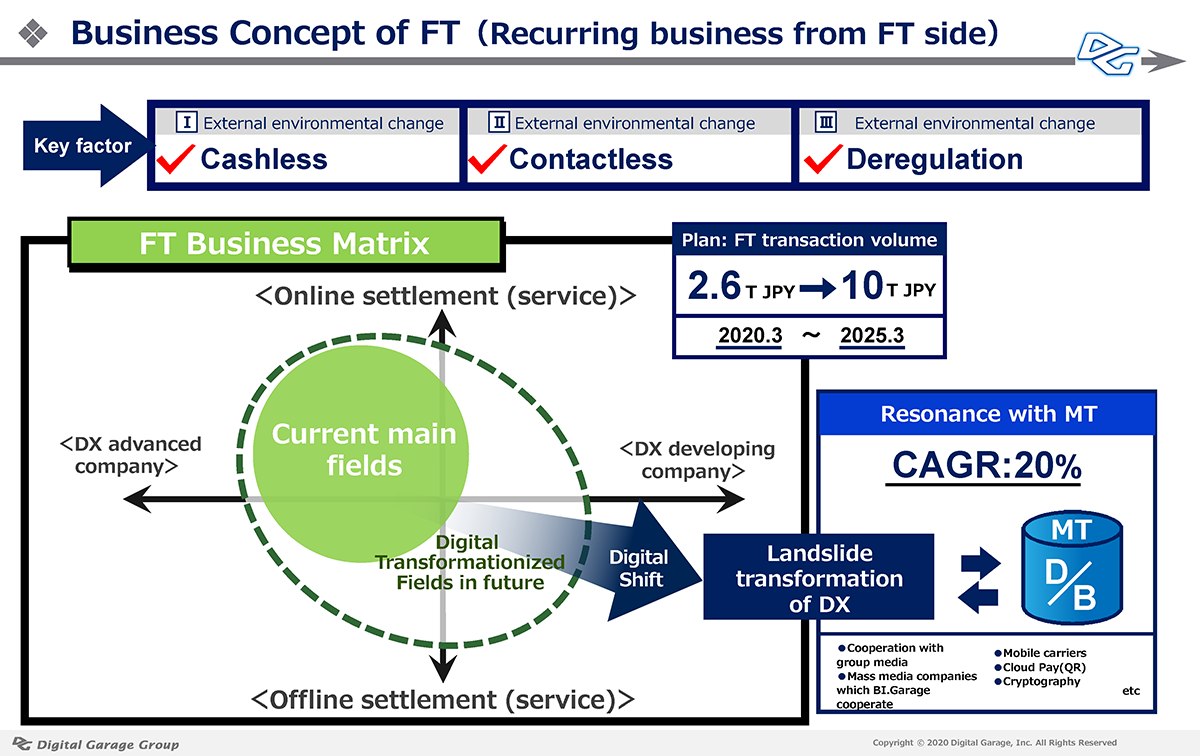

FT (Financial Technology Segment)

In FY20.3, revenues in FT segment increased 15.6% YoY, while profit before tax increased 20.9% YoY to 4.049 billion JPY, for double-digit growth in both revenues and earnings and record earnings. As a KPI, transaction value increased 24% to 2.6 trillion JPY and transaction volume increased 24% to 486 million. Payments for inbound and travel-related transactions declined toward the end of the fiscal year, but overall growth continued as the mainstay e-commerce and face-to-face payments expanded at an accelerating pace.

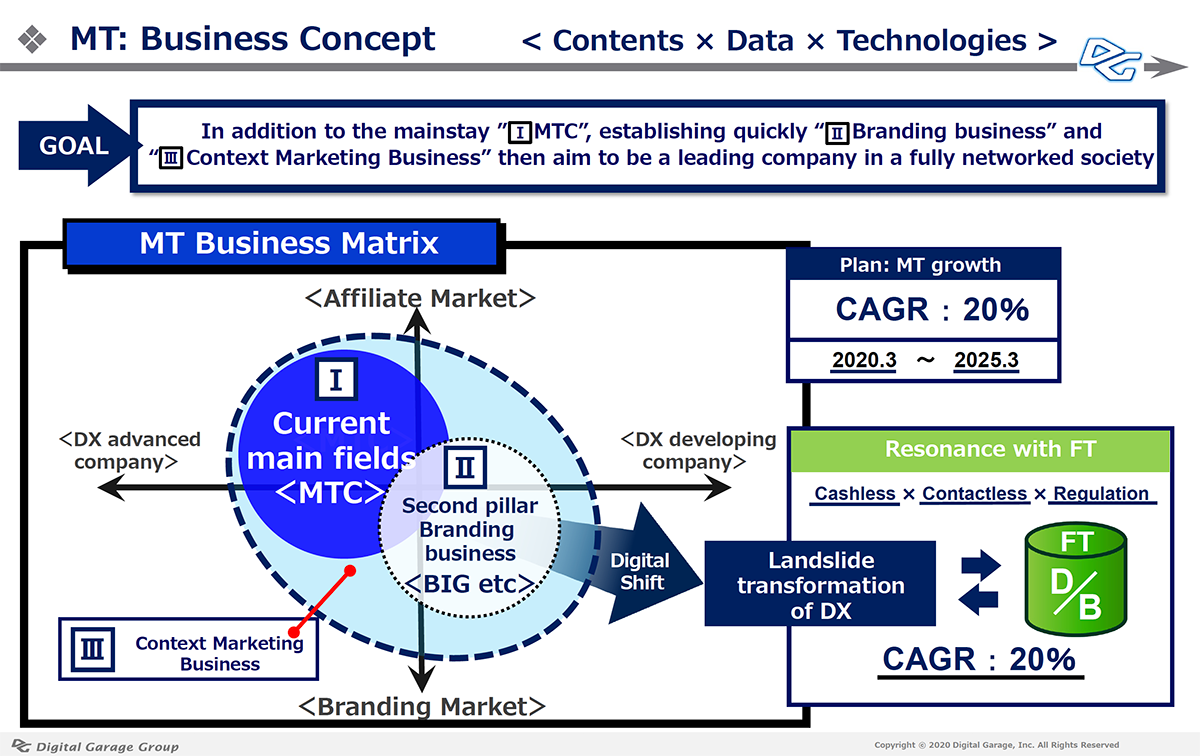

MT (Marketing Technology Segment)

Revenues in MT segment increased 19% YoY, and profit before tax improved significantly, rising 52% YoY, to 1.853 billion JPY. In the mainstay Performance Ad business, we are capturing demand for advertising from financial and payment service providers and making progress in improving profitability. We are accelerating the provision of integrated solutions for DX clients, from digital promotions to app/wallet development and data utilization measures. In addition, we are developing Japan’s first mass media consortium, aiming to create a new marketing contexts platform for the post-cookie era in the medium term for advertisers and the media.

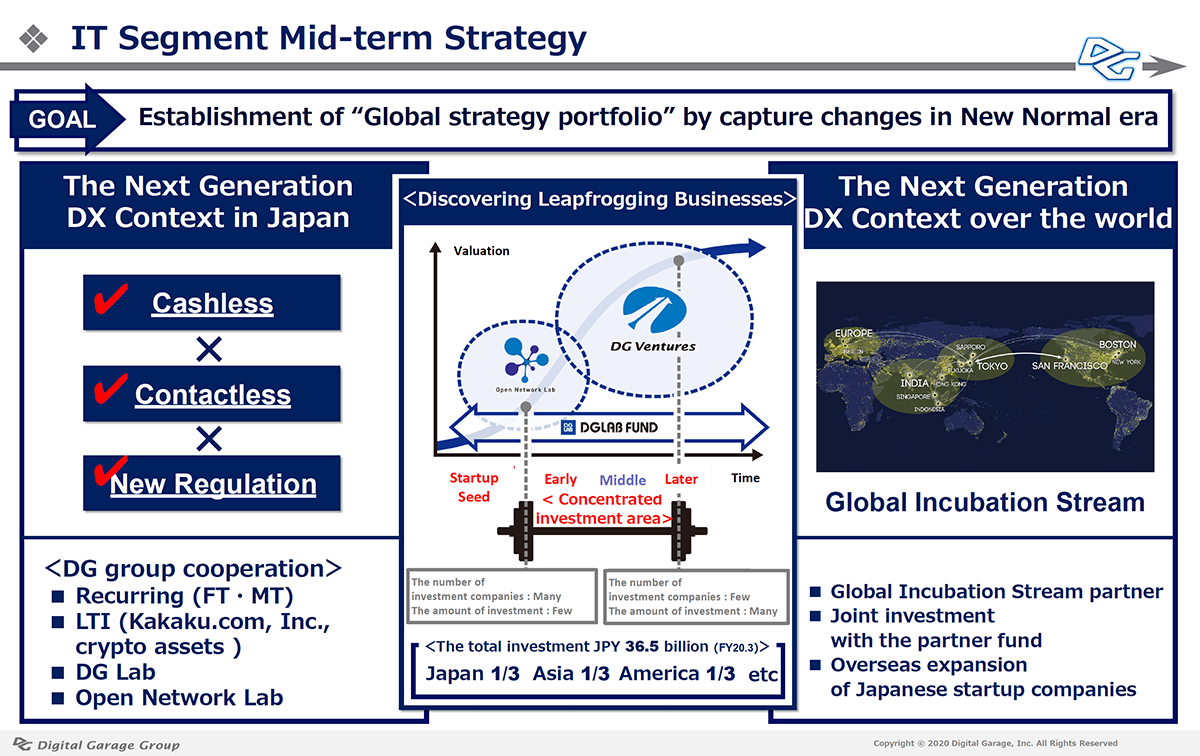

IT (Incubation Technology Segment)

IT segment is characterized in that the difference between the fair value of the shares held at the end of the period and the value at the end of the previous period is recorded as revenue in IFRS income statement. Revenues decreased 39.3% YoY, and profit before tax decreased 48.3% YoY to 3.563 billion JPY. In addition to the absence of valuation gains on large-scale sales in the previous fiscal year, the appreciation of the yen had a negative impact of approximately 1.2 billion JPY on the valuation of foreign currency denominated stocks. Meanwhile, the balance sheet value, or the value of operational investment securities, which is an indicator emphasized by IT segment, was 36.546 billion JPY, an increase of 9.8 billion JPY from the end of the previous fiscal year.

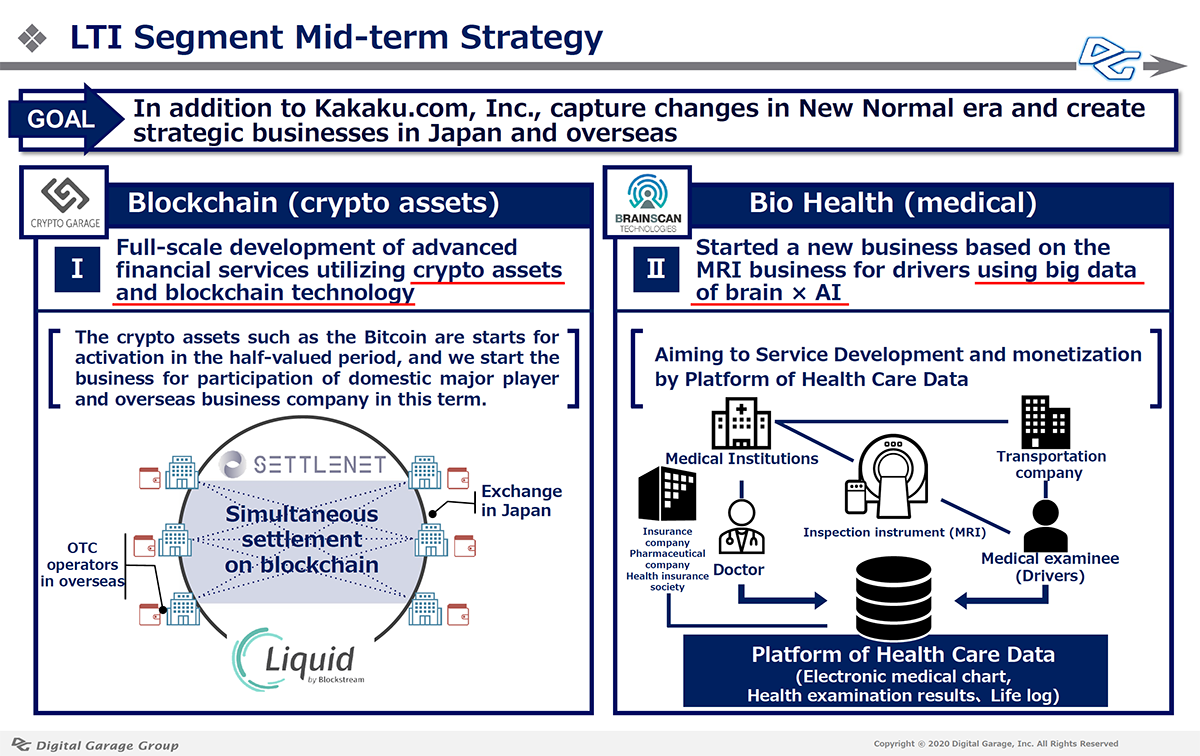

LTI (Long-term Incubation Segment)

LTI segment aims to achieve long-term growth in operating profits through the ongoing holding of investee shares and the development of new businesses. The performance of our mainstay Kakaku.com, Inc. (TSE 2371) steadily expanded and contributed to an increase in equity in earnings of affiliates. In addition, Crypto Garage, Inc., a joint venture with Tokyo Tanshi Co., Ltd., began offering crypto asset-related services in June for the first time, and plans to launch full-scale operations during the new fiscal year to develop blockchain financial services globally.

Ⅱ. New Five-Year Mid-term Plan Digest

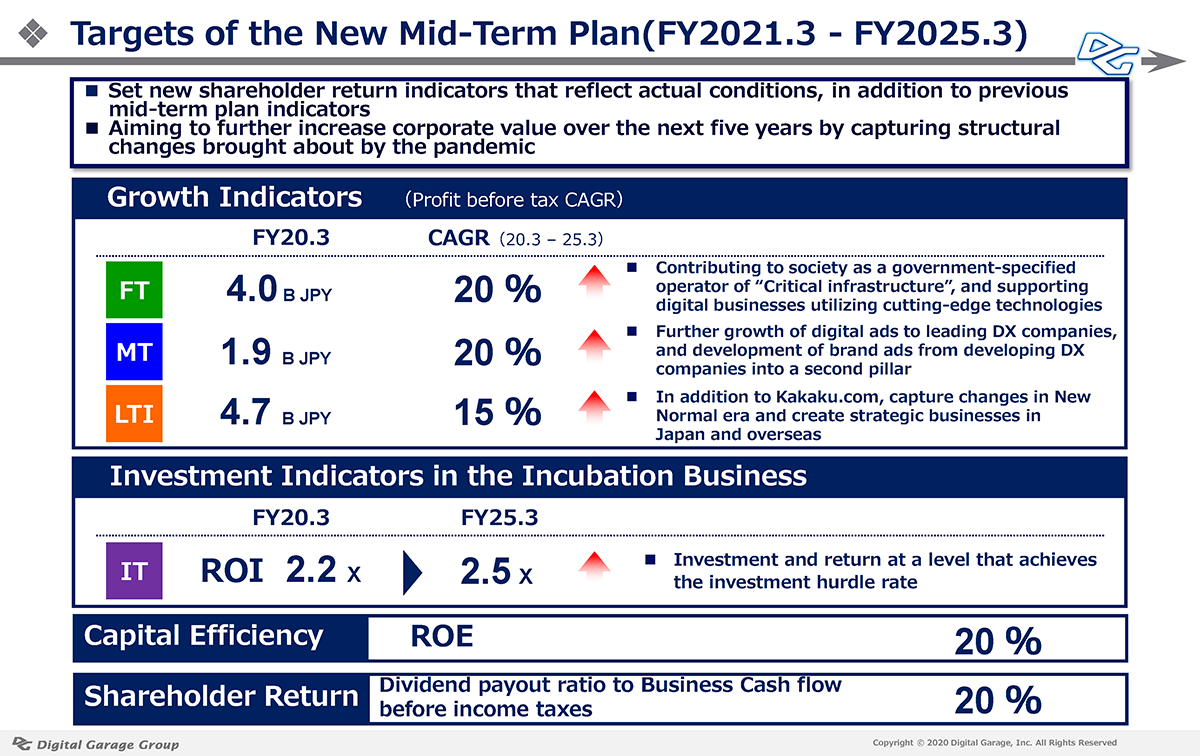

Since FY21.3, we have formulated a new five-year Mid-term Plan. As in the previous year, quantitative targets were set as growth indicators for the recurring business and investment hurdle rates for the IT investment business. In our recurring businesses, the FT and MT segments, we have nearly achieved the 15% profit growth target set in the previous mid-term plan and have set a profit growth target of 20%, which is even higher than the previous plan. The LTI segment targets 15% growth. In addition, we continued to set the return on equity ratio at 20%. With regard to indicators for shareholder returns, we have newly set a target of a dividend payout ratio of 20% using annual business cash flow as the denominator, as a company subject to voluntary application of IFRS, with elimination of non-cash flow, mainly profit from fair value valuation of IT segments, etc.

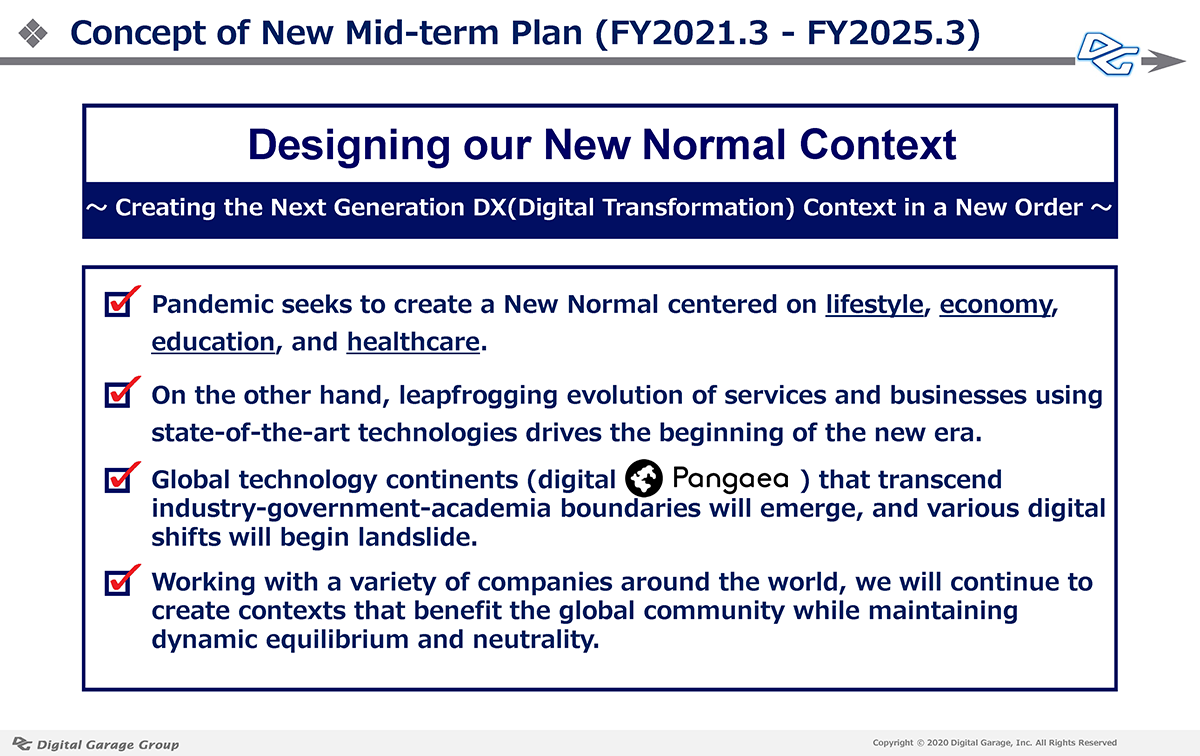

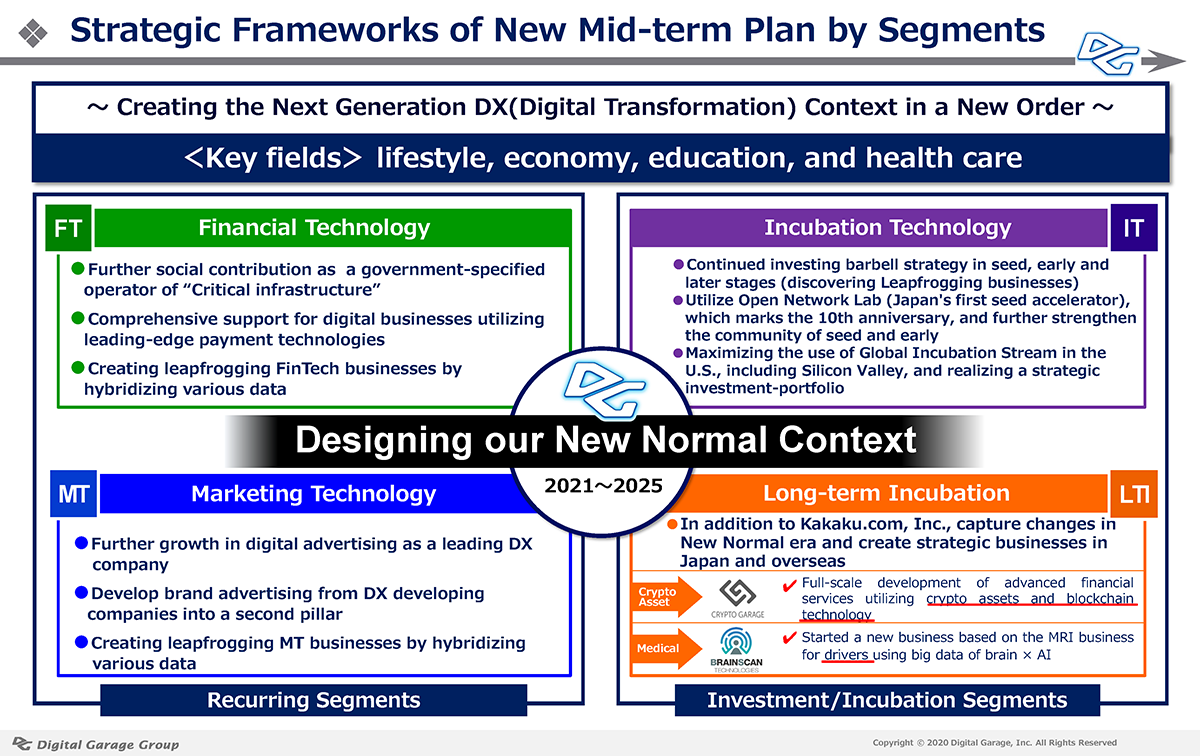

Digital Garage starts a new Mid-term Plan for the next five years under the concept of “Designing our New Normal Context” from this fiscal year. As COVID-19 has led to the collapse of the vertical social model and the acceleration of experimental deregulation, the New Normal is emerging, centered on lifestyle, economy, education, and healthcare. The services and businesses using the latest technology will further leapfrog in a global scale to drive the new era. It is clear that various digital shifts will occur, and a global technology continent (Digital Pangaea) that transcends the boundaries between industry, government, and academia will emerge to create a landslide transformation. As with the dawn of the Internet, when DG has started, it is essential to coordinate the rapid implementation of reforms across boundaries between nations, corporations, non-profit organizations and educational institutions. We strongly believe that it is time for DG, which has promoted open incubation in the previous Mid-term Plan, to accelerate collaboration with various partners on a global scale, and continue to create contexts that are useful to the international community in maintaining dynamic equilibrium and neutrality.

The FT segment, which takes on social responsibility as a company designated as a “critical infrastructure” by the government, operating 24 hours a day, 365 days a year under any circumstances, will support the New Normal era by utilizing the strengths of the DG Group, with a focus on 3 key factors, Cashless, Contactless, and Deregulation. As the outbreak of the COVID-19 accelerates the changes, DG will pay close attention to the needs of consumers in both the face-to-face and non-face-to-face payment fields, and will continue to provide comprehensive support for digital businesses by utilizing the most advanced payment technologies. We also aim to create a Leapfrogging Fintech business by hybridizing various types of data.

The MT segment aims to establish a “digital marketing ecosystem” for the New Normal era.

While further expanding digital advertising for companies in the advanced DX market, we will develop brand advertisement marketing for companies in the developing DX market, as the second pillar of our segment business. Centered on the “Japan Premium Media Consortium,” which Digital Garage has operated since 2018 with the participation of more than 40 major media companies, we are steadily making preparations to promote media design that enables tailor-made communication adapted to each user. With an eye on data marketing in the cookie-less era, it is our aim to attract high-quality advertisements to quality media such as responding to ad frauds, ensuring strict brand safety, and setting appropriate media costs for quality media with high content value.

Next is the IT segment. We are convinced that this pandemic will trigger a landslide change of DX on a global scale in various areas, such as “lifestyle, economy, education and healthcare.” This tremendous shift will affect the ICT business companies we invest in, polarizing into those that hit the brakes and those accelerates. On the other hand, emerging countries are increasingly likely to experience a mutation of leapfrogging business creation. We will continue our flexible investment and incubation business with a barbell strategy to diversify risk while working with global partners that we have networked with over 25 years since our founding.

In the LTI segment, Crypto Garage, which had received official authorization to conduct the first blockchain and finance project under the Regulatory Sandbox in Japan, managed by Cabinet Secretariat of Japan in 2019 and had started a PoC of a service for issuing yen-denominated tokens and simultaneous settlement of crypto assets using SETTLENET, is now preparing to commercialize the service. Since the pandemic, bitcoin’s halving arrives and reinvigorates the market. We start a full-fledged preparation to cultivate a global platform business originating from Japan in the area of crypto assets.

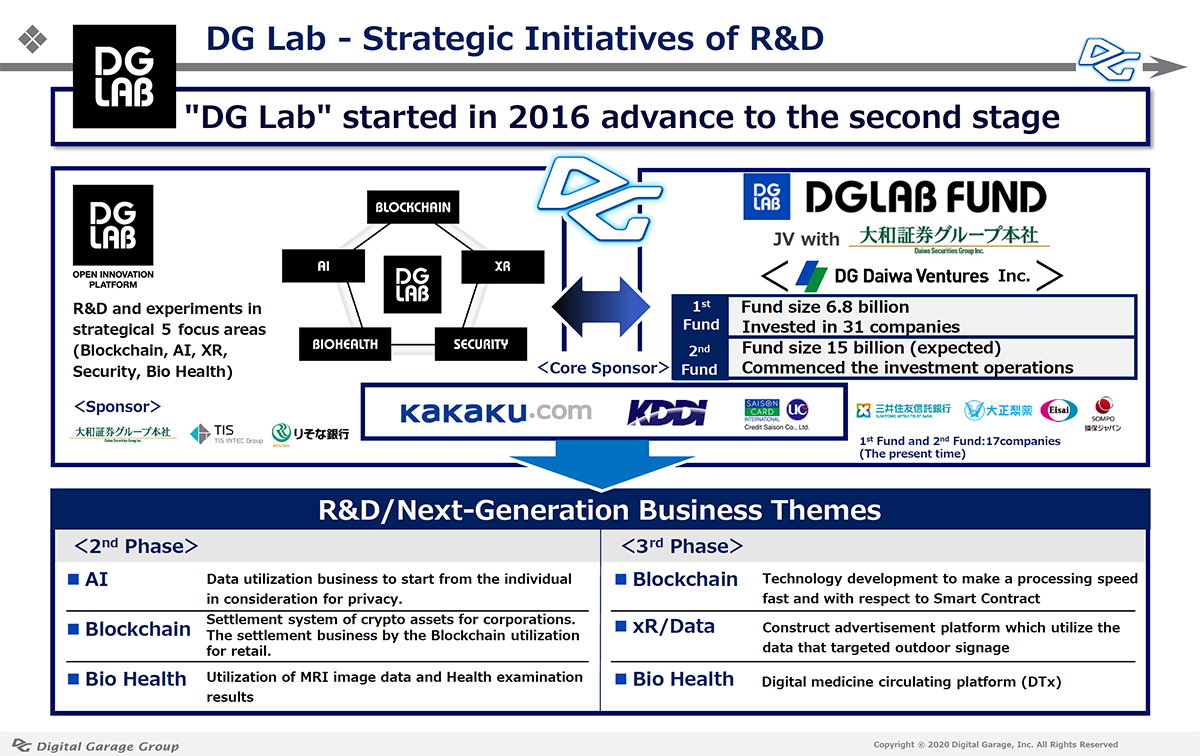

Next, we will discuss DG Lab, our group’s R&D engine. In collaboration with our core partners Kakaku.com, Credit Saison, and KDDI, we continue to promote research, development, and commercialization of innovations with a focus on five key areas: Blockchain, AI, xR, Security, and BioHealth. DG Lab Fund, which invests and incubates leading domestic and international startups in these five key areas, launched its second fund last year. We aim to manage the first and second funds with a total value of approximately 25 billion yen. Through collaboration with the DG Group, partner companies and funded LPs, a variety of projects are emerging, including a second stage fintech business using blockchain technology, an information banking project linked to AI, and a new project in the bio-health category.

The concept of our Mid-term Plan, “Designing our New Normal Context,” encompasses not only the business but also the DG’s commitment to the ESG domain. We have already incubated environmental startups and supported projects in collaboration with Shibuya Ward, as well as the Tohoku Youth Orchestra, a project led by artist Ryuichi Sakamoto that aims to support the mental growth of children in Tohoku. Further on a global scale, we will provide full-fledged support for NPOs launched by Joi Ito, DG board of directors member and co-founder, and Reid Hoffman. Starting with the project cope with COVID-19, which will be promoted by a network of experts in Boston, the world’s mecca for biotechnology, the DG Group will collaborate on a variety of projects to support and promote social contribution projects tol create the New Normal.

Please refer to the next slide for overview.

The first pandemic in 100 years has brought all sorts of disasters to humanity. At the same time, a global technology continent (Digital Pangaea) is being formed that transcends the boundaries between industry, government, and academia, for the first time since the spread of the Internet.

Digital Garage, which is celebrating its 25th anniversary this year, will continue to contribute to global society under the concept of “Designing our New Normal Context” for the next five years as a Context Company, unchanged since its founding.

We look forward to the continued support and encouragement of our stakeholders, including our shareholders.