CEO Comments

Kaoru Hayashi

Representative Director,

President Executive Officer and Group CEO,

Digital Garage, Inc.

Volume 79, 2023.08.09

CEO Comment Vol.79 “FYE March 2024 First Quarter Financial Report Summary”

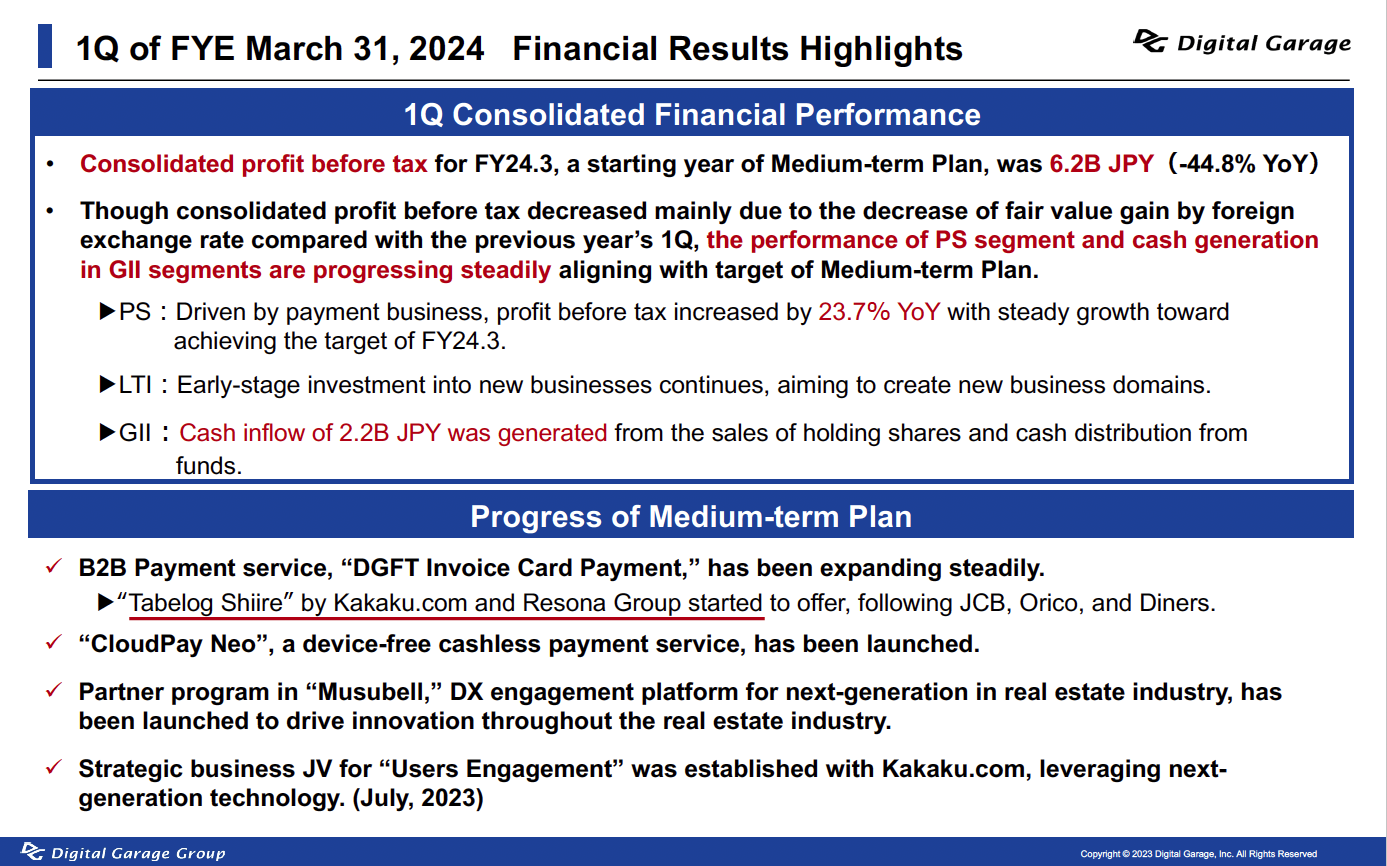

Overall businesses have smoothly started in the first quarter of FYE 24.3, the first fiscal year of Medium-term Plan, despite decline in profits in response to currency fluctuations by foreign exchange.

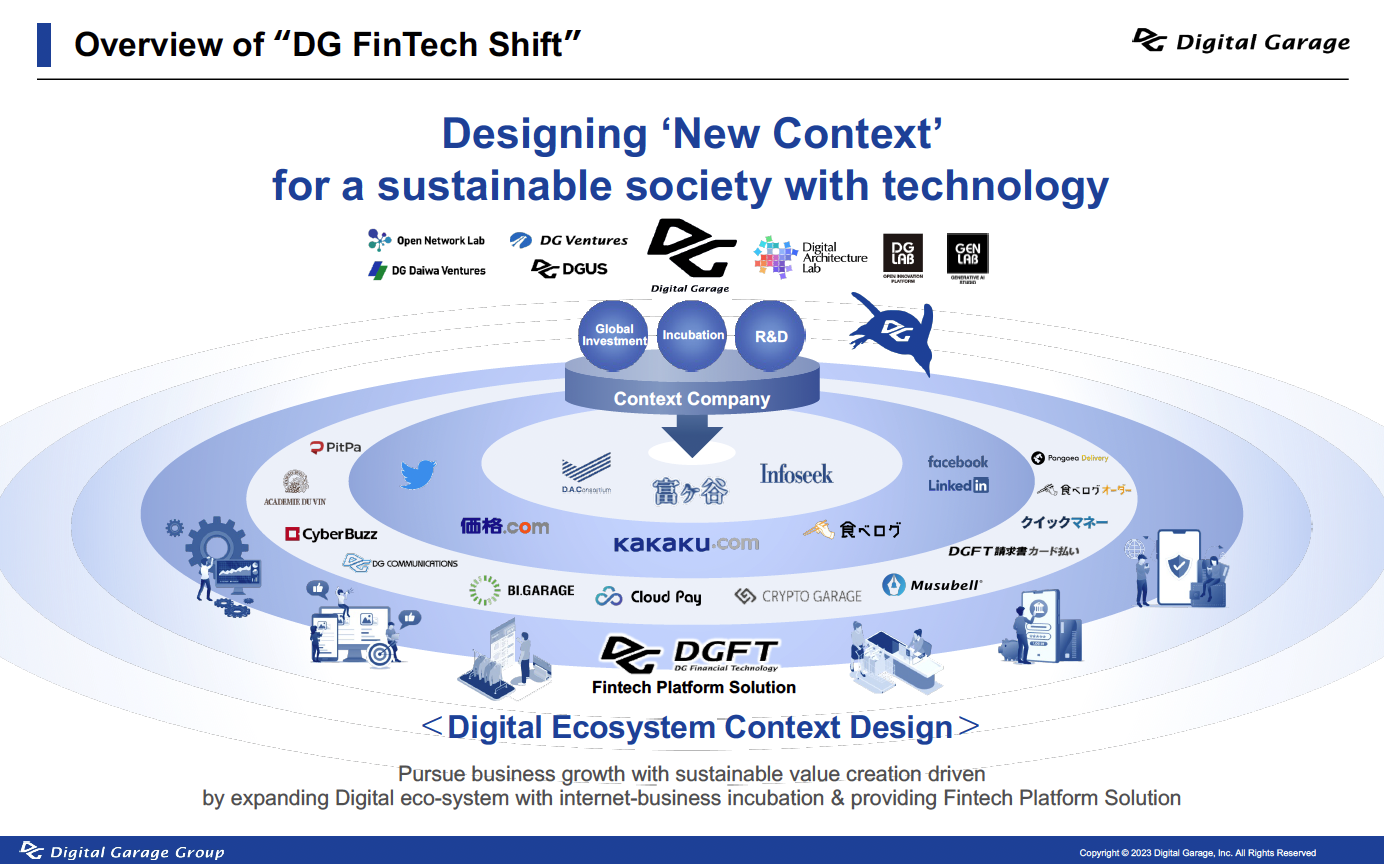

~Strategic initiatives and new businesses for “DG FinTech Shift” have sequentially launched~

With the approval of the Board of Directors today, we have announced FYE 24.3 first quarter financial results (IFRS)

Ⅰ. Summary of FY24.3 First Quarter Financial Report Summary

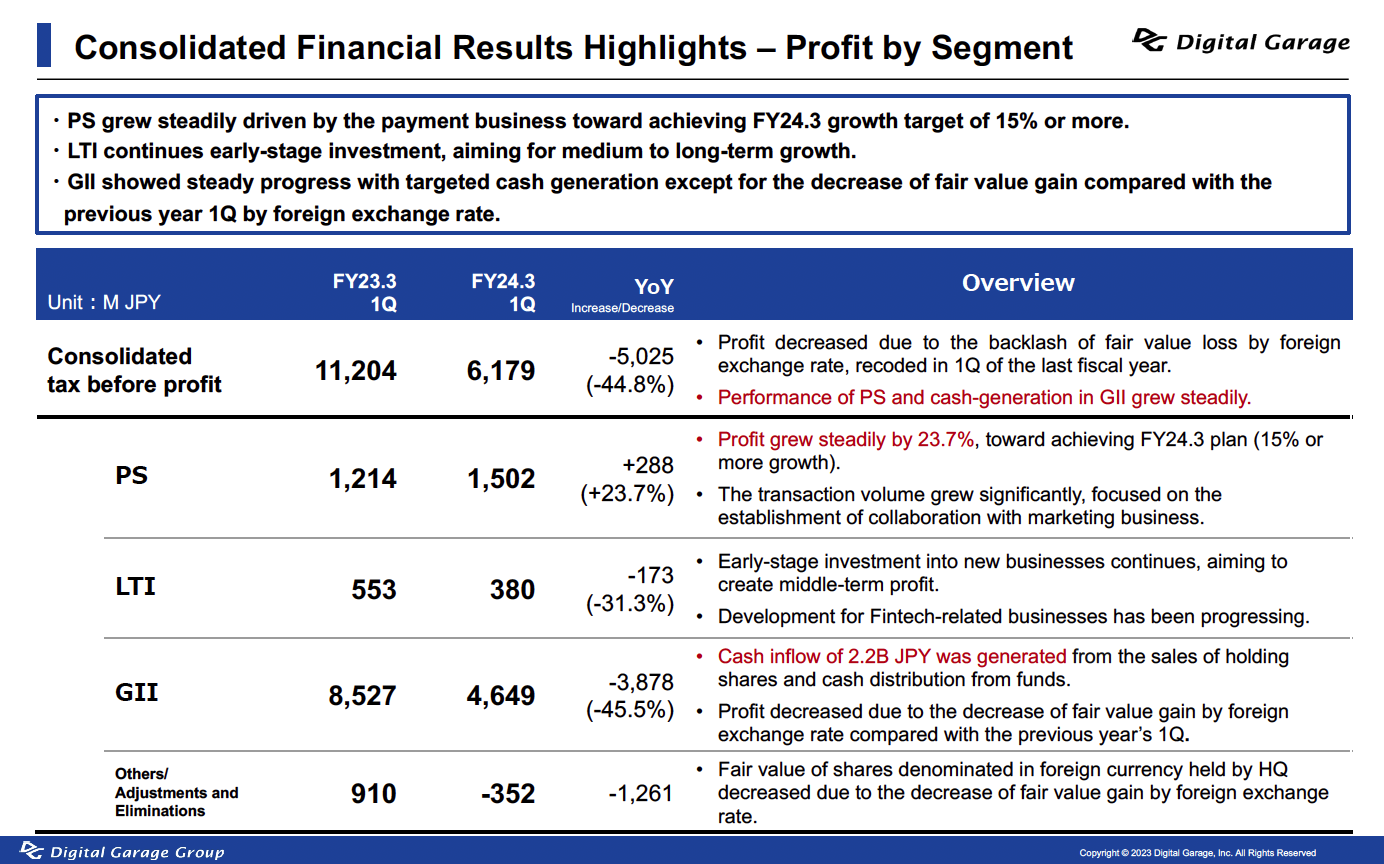

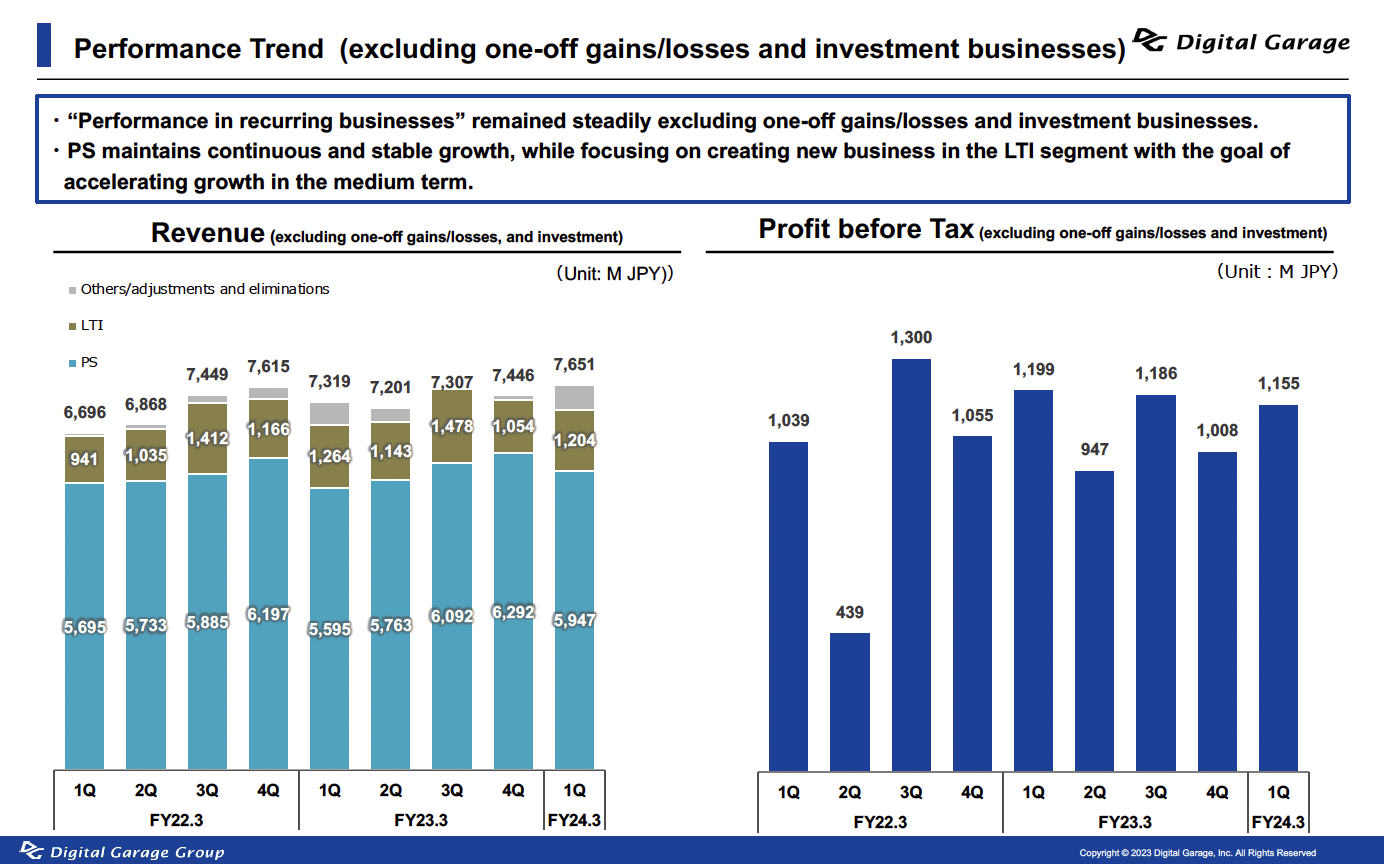

As for the business performance in 1Q of FYE March 31, 2024, revenue was 13,187 million JPY (down 25.6% YoY) and profit before tax was 6,179 million JPY (down 44.8% YoY). Although the yen has been weak in foreign exchange market, as in 1Q of the last fiscal year, consolidated revenue and profit before tax decreased due to the decrease of fair value gain of securities denominated in foreign currency compared with the previous fiscal year.

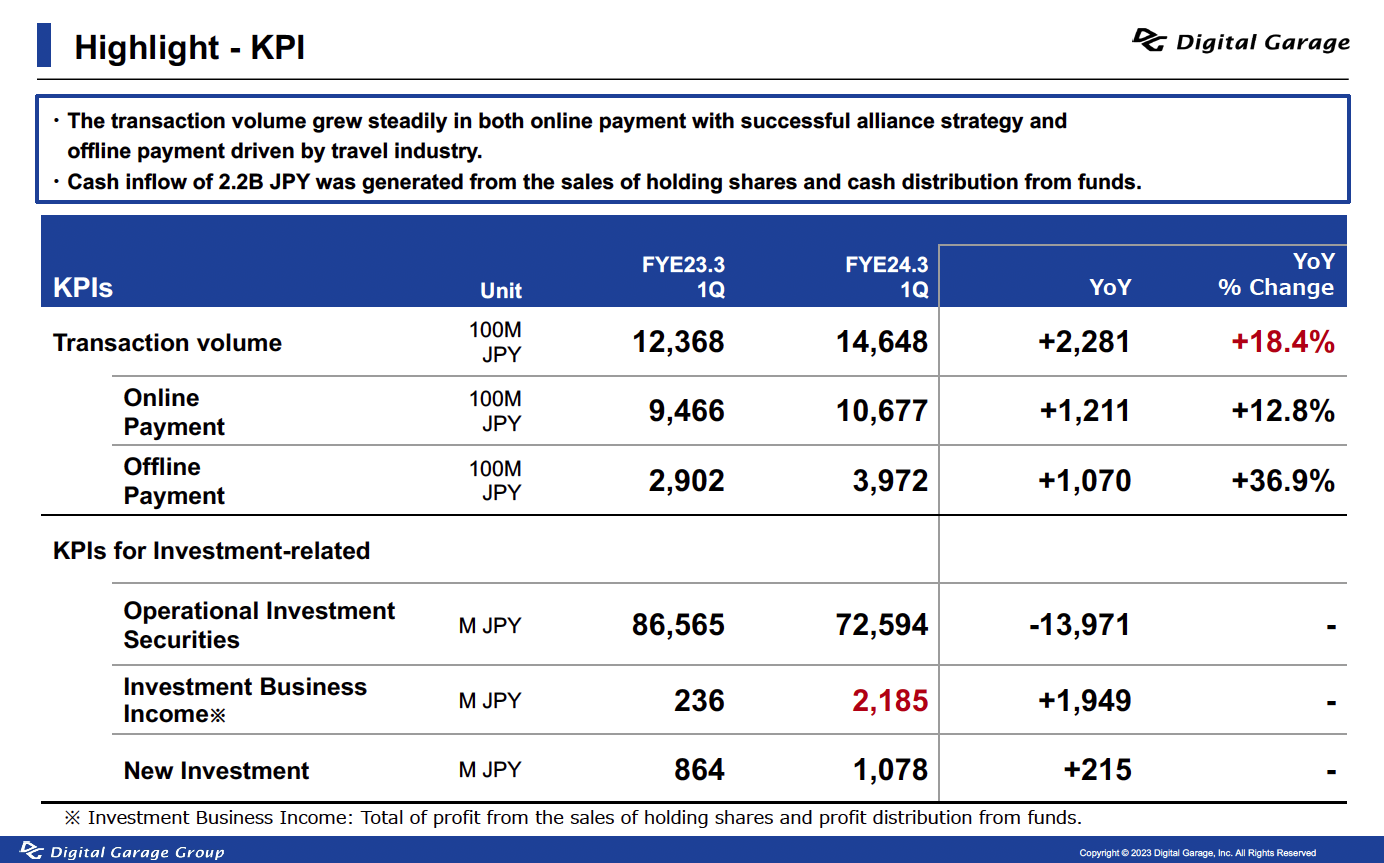

On the other hand, Platform Solution (PS), our core business, which is expected to continuously increase profit, significantly grew in the transaction volume YoY, especially in the travel and restaurant industries due to containment of COVID-19. With accelerating development of merchants by alliance strategy in the offline payment area, profit before tax in PS segment increased by 32.0% YoY.

Though profit before tax in the marketing business decreased by 37.5% due to strategic transition to “DG FinTech Shift,” aiming to strengthen collaboration with the payment business, the total profit before tax in PS segment was 1,502 M JPY (+23.7% YoY) with steady progress toward achieving FY24.3 growth target of 15% or more.

In Long-term Incubation (LTI) segment, early-stage investment into new businesses continues, which drives the Group’s medium to long-term growth. Also, new businesses such as credit card payment services for B2B and “Musubell,” DX engagement platform for next-generation real estate transactions, begin to show results.

Global Investment Incubation (GII) showed a smooth start as the first year of Medium-term Plan. Generating cash inflow of 2.2 B JPY from the sales of listed company shares, cash distribution from funds and maintaining successively solid investment balance.

Please see the following slides for “FYE March 2024 First Quarter Financial Report Summary.”

Please see the slides below for details.

II. Overview of Business and Updates on DGFT, the Core of the DG Group Fintech Business

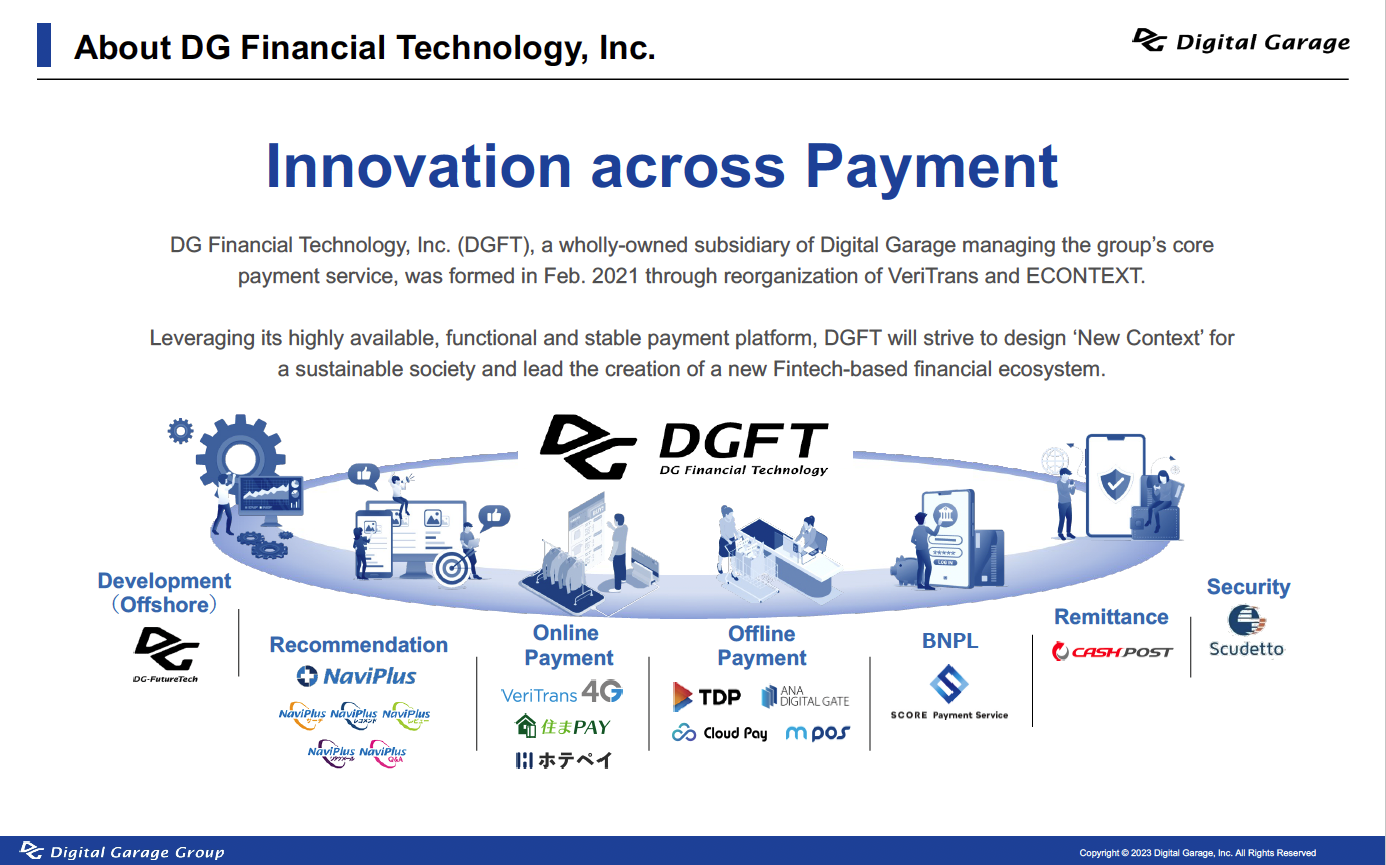

Since the beginning of the Internet, ECONTEXT, which support digitizing cash payments with e-commerce payments, and VeriTrans, which support digitizing e-commerce payments with credit cards, have integrated to establish DG Financial Technology (DGFT), one of the largest payment service providers (PSP) in Japan, in 2021. Under the “Innovation across Payment” theme, DGFT is developing various payment-related and data-utilizing businesses using advanced technologies. Below are the business overview and new initiatives.

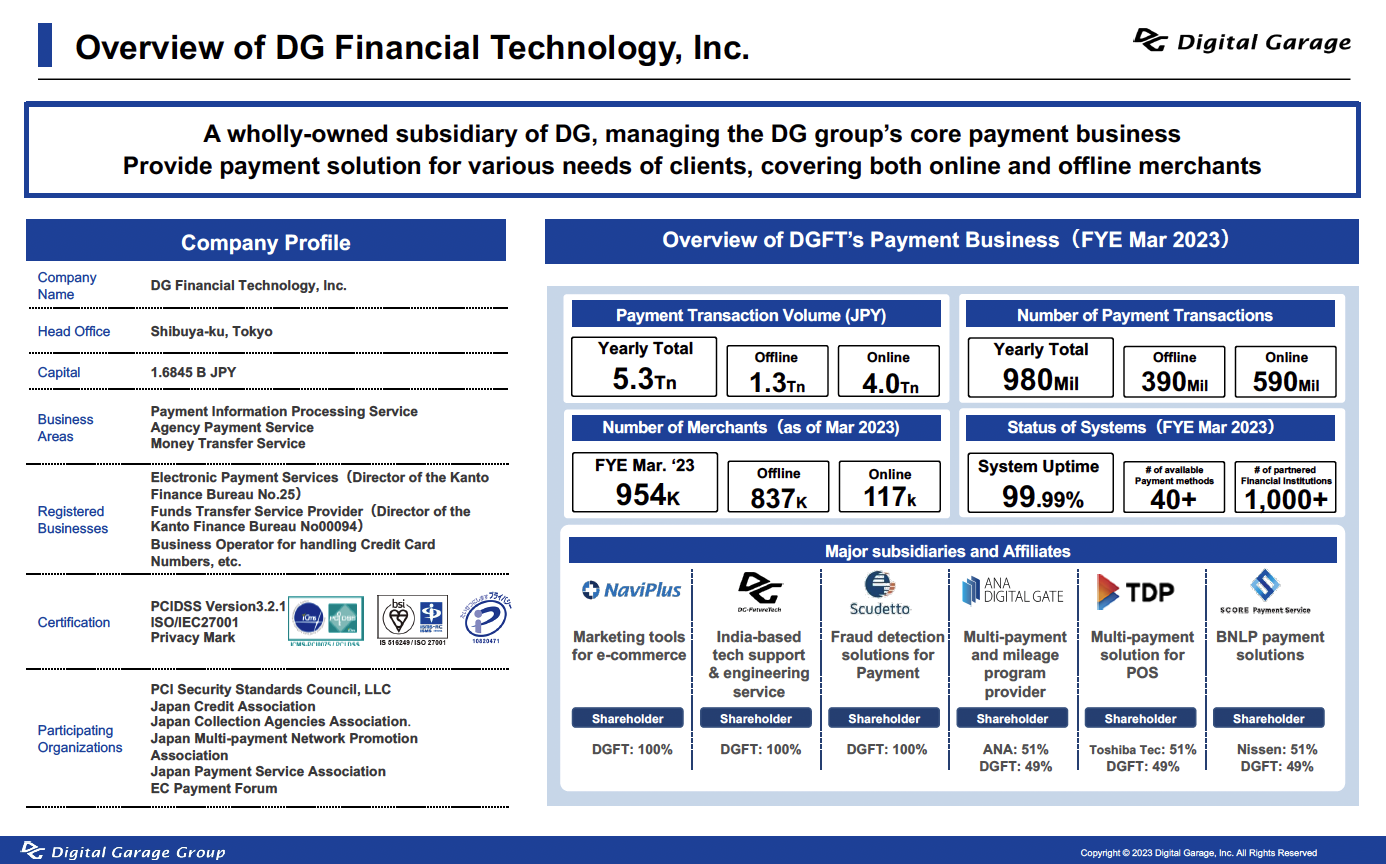

By the fiscal year ending March 2023, DGFT’s payment transaction volume exceeded 5 trillion yen, and the number of payment transactions expanded to nearly 1 billion. DGFT has grown to become one of the leading operators in Japan. As part of its efforts to support the growth of clients’ businesses, DGFT is developing marketing tools and fraud detection solutions in addition to its PSP business.

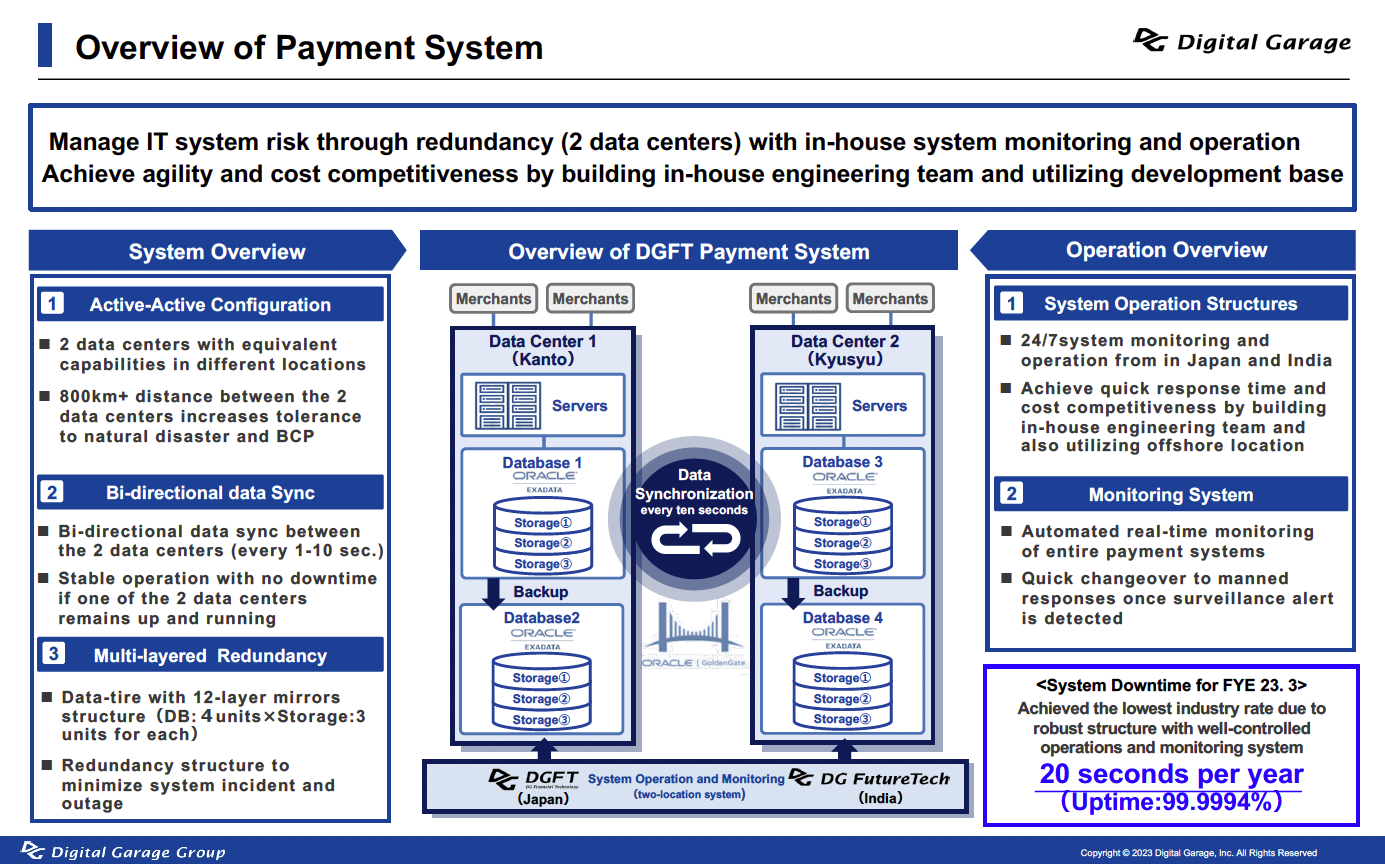

Also, to maintain stable operation of the payment system, DGFT has built and operates its proprietary system ahead of the competitors. It is designed to synchronize data bi-directionally between data centers every 1 to 10 seconds and to work without downtime in the case of a system failure in one of the centers, as well as to operate and monitor the system 24 hours a day, 365 days a year from two locations in Japan and India. The system is proud to be recognized as Japan’s leading payment system, combining security and operational systems equivalent to those of major financial institutions with advanced technology.

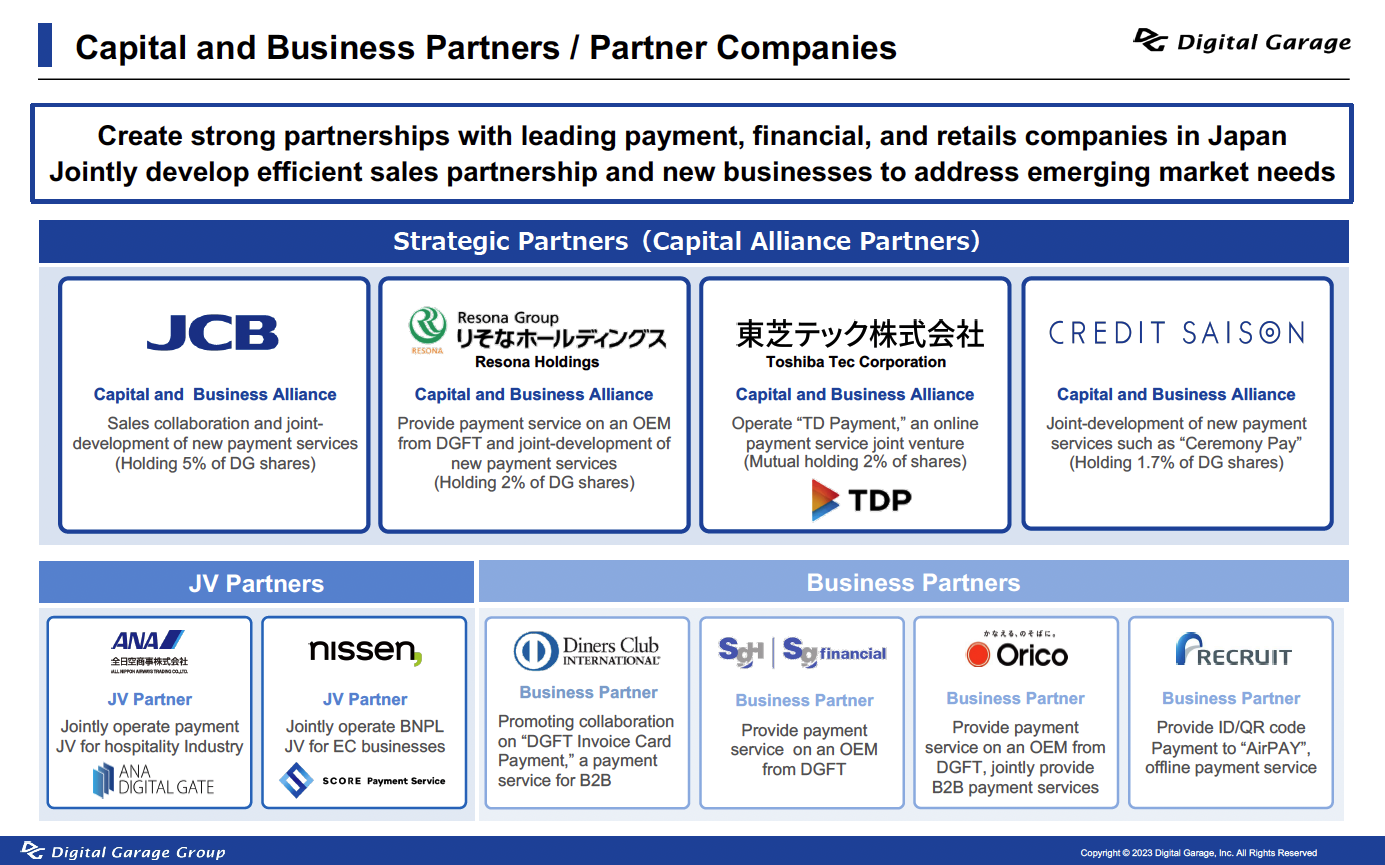

To accelerate the growth of DGFT’s business, we have formed alliances with leading companies in various industries, including major credit card companies, the leading POS system providers, and banking groups, to enhance our sales capability and develop new services. Below is a list of partner companies in addition to the capital and business alliance partners.

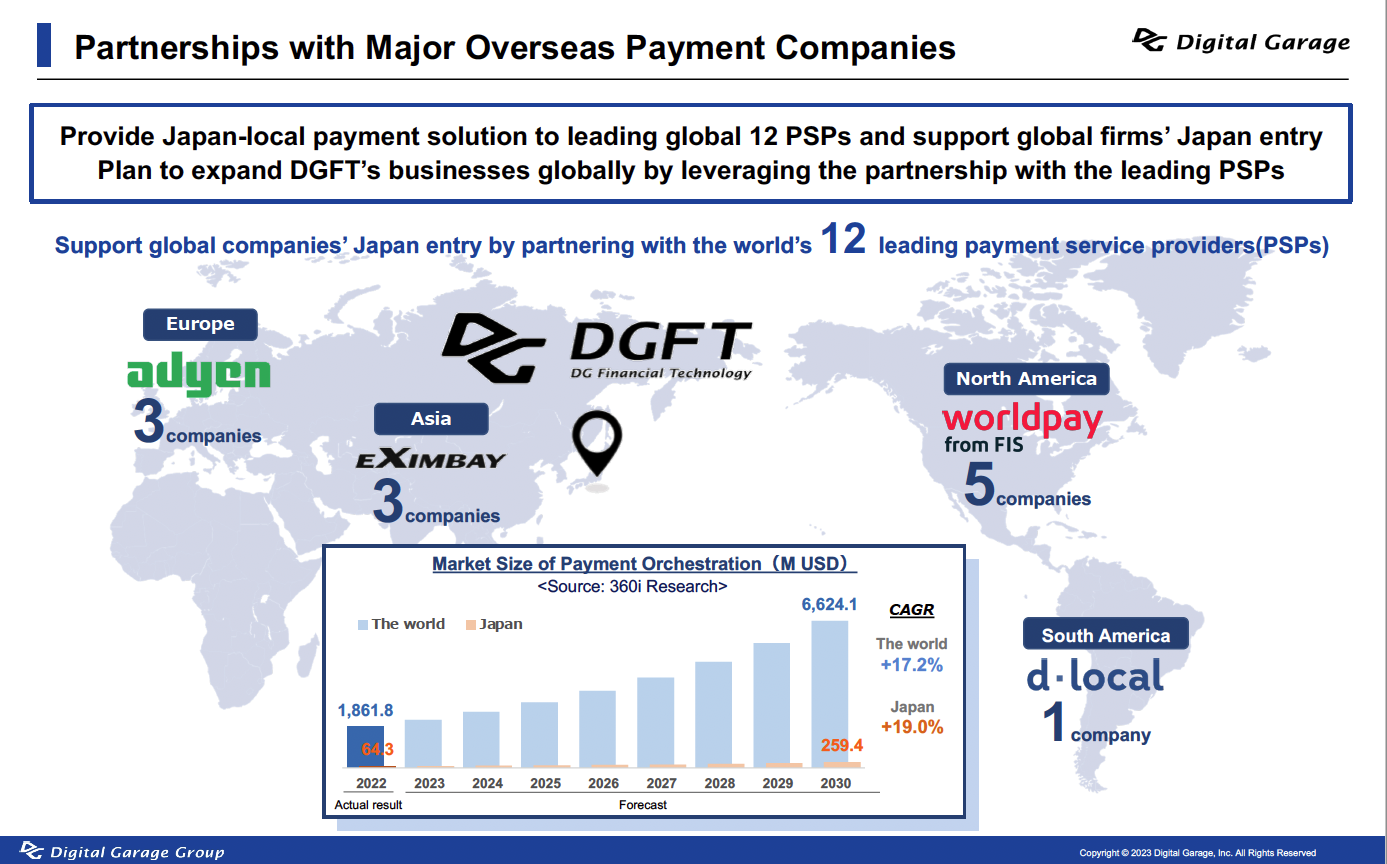

As for new initiatives, we are preparing new strategic businesses and products based on the DG Group’s payment business. With the impact of COVID-19 being settled, inbound and outbound business is reviving, and the demand for cross-border e-commerce is increasing. We are developing

Please see the overview below.

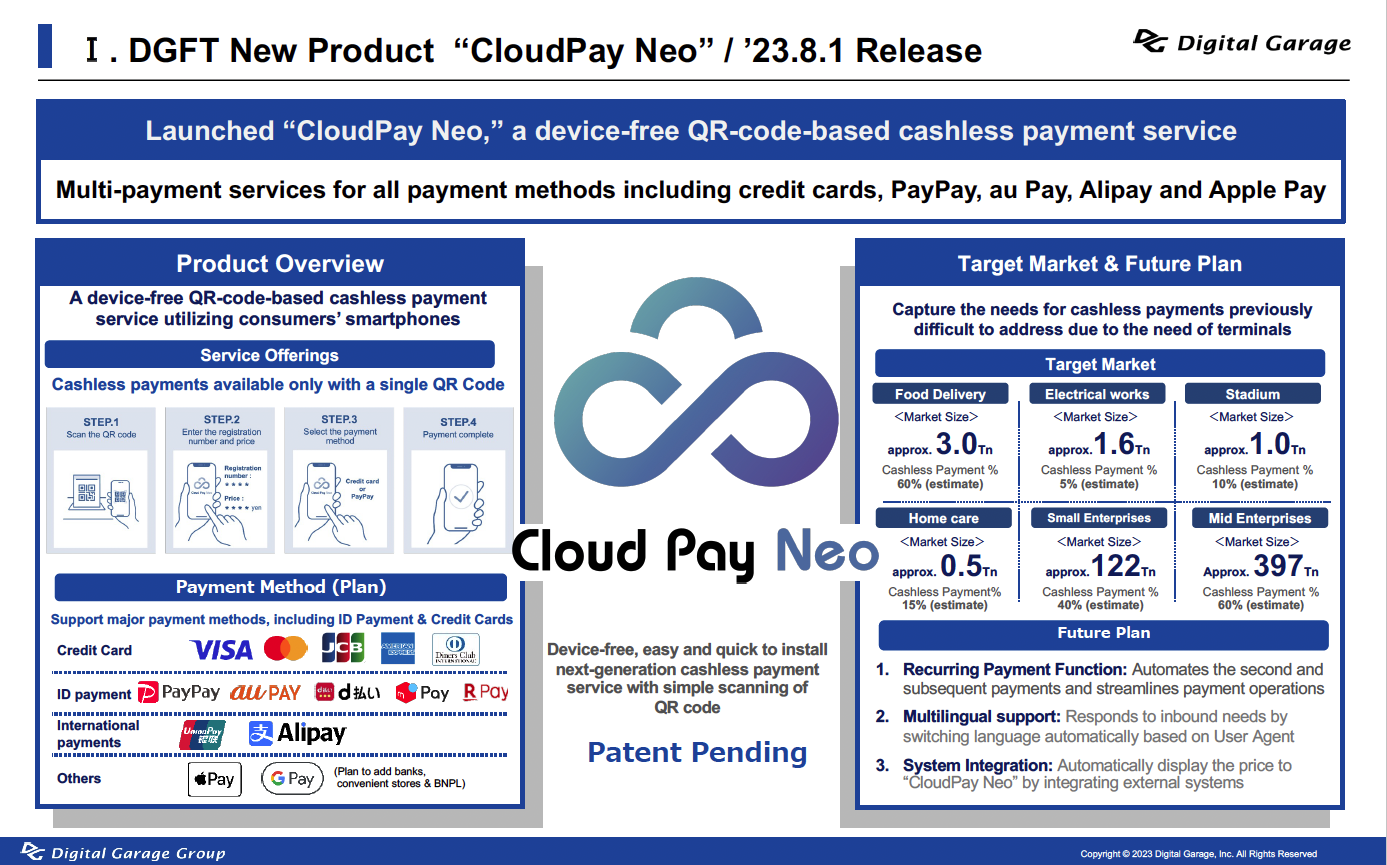

New Fintech products have also been launched in response to the diversification of consumers’ lifestyles and payment methods. “CloudPay Neo” is a device-free cashless payment service that supports various payment methods, such as credit cards, PayPay, au Pay, Apple Pay, and Alipay, without payment devices or system development.

“CloudPay Neo” can be quickly introduced with a QR code. It is suitable not only for restaurants and retail stores, which have installed many of DGFT’s payment systems, but also for travel, on-site services, and events. Since the system does not require a payment device, it is expected to be utilized even in the case of disasters and power outages and thus can serve as a social infrastructure.

There is high demand for this service from many companies and credit card companies because of the low cost of implementation. We also plan to expand the service’s functionality, including adding a BNPL.

Japan has a cashless payment market that exceeded 100 trillion yen in 2022, but the rate is currently only 36%, with more significant potential for growth than in the U.S. and Europe. With the “DG FinTech Shift” strategy, DG Group will support DX in Japan by providing a frictionless and convenient payment and financial service platform that ensures financial flow.

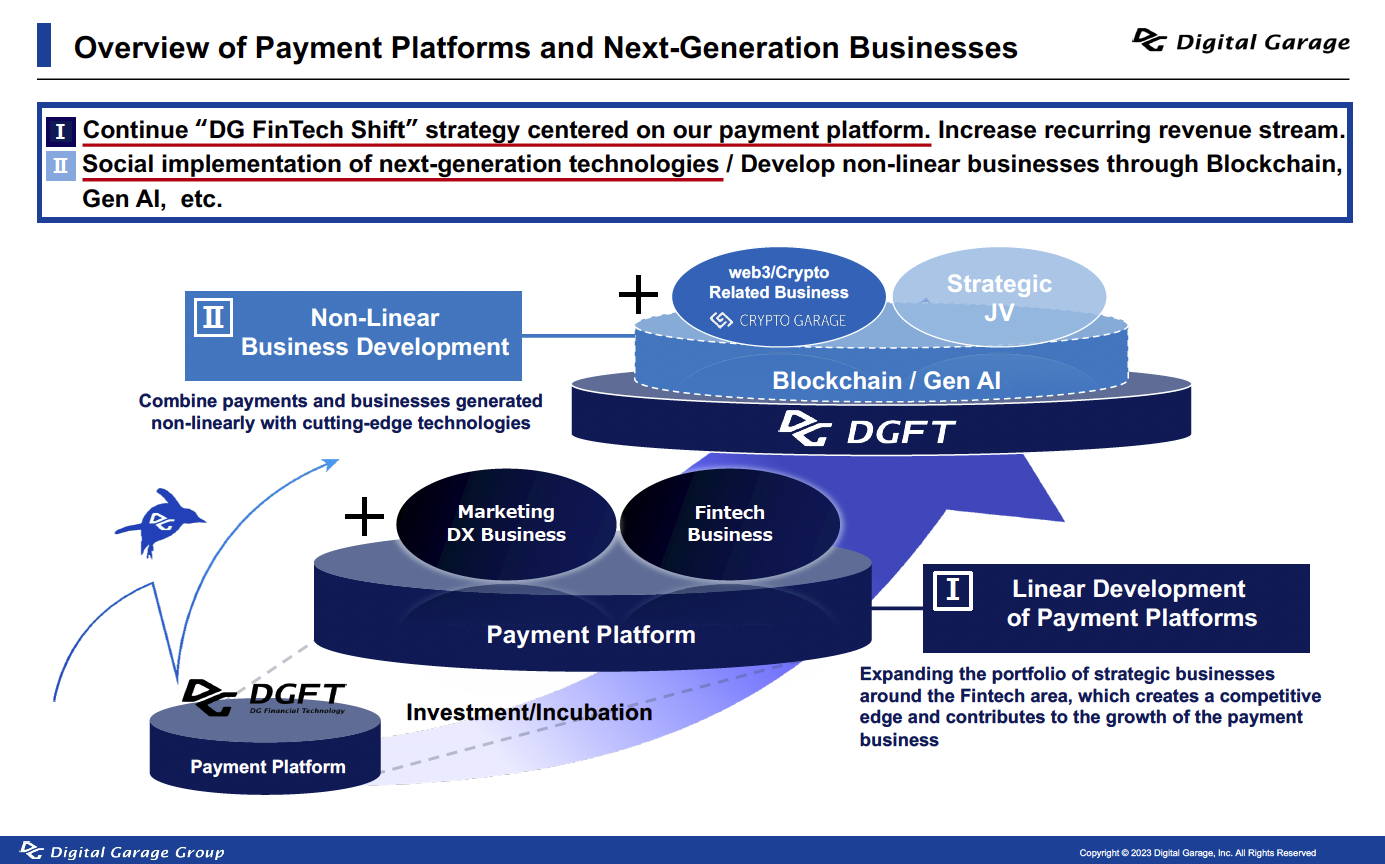

III. Strategic Initiatives and New Business Development Projects Overview

DG group is working on [I] and [II] on the slide below.

[I] Continued development of payment platforms

[II] Fostering non-linear businesses

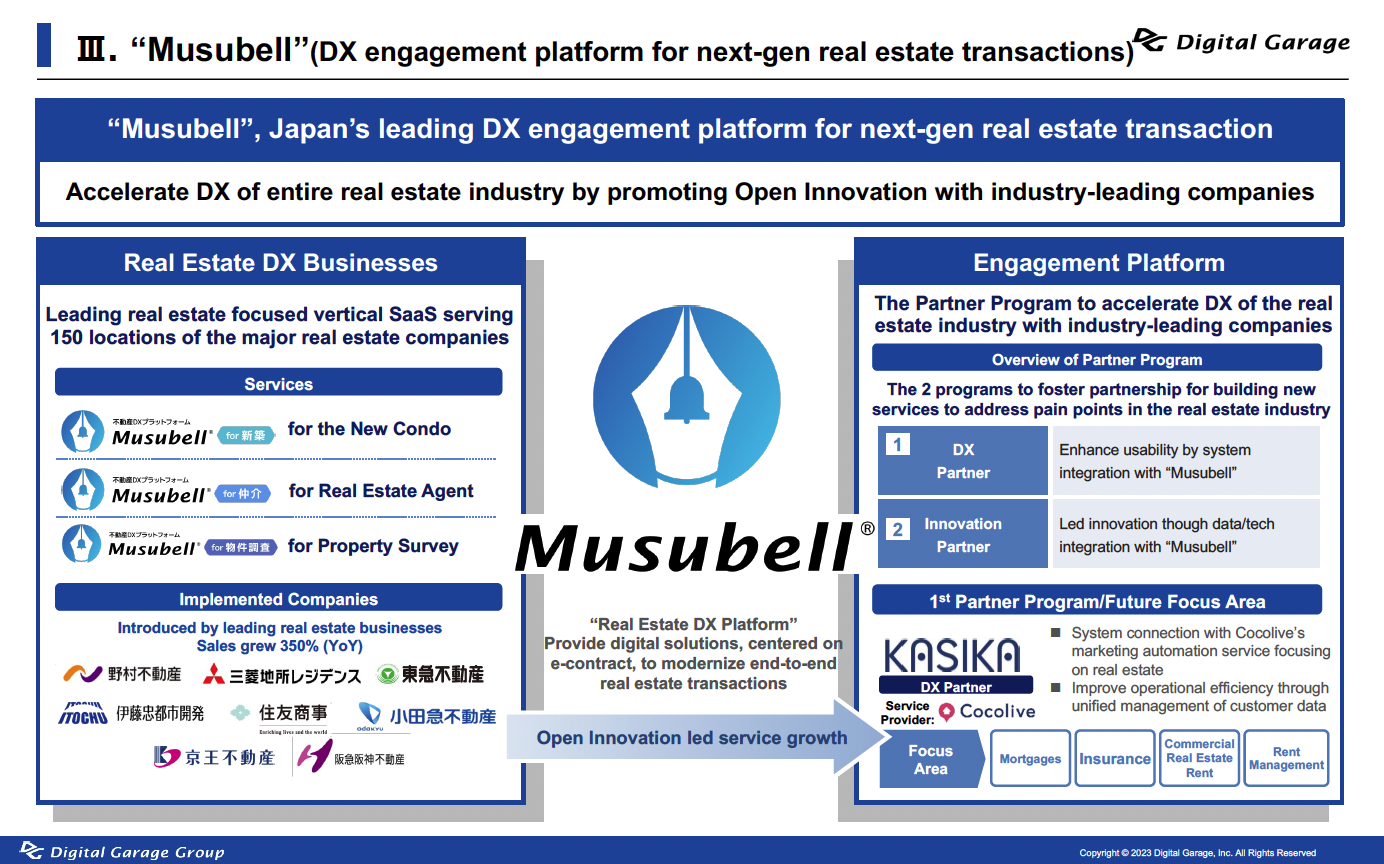

First, the key driver of [I] is “Musubell,” a SaaS business specializing in the real estate industry that we have focused on for several years. Since launching a comprehensive real estate contract management service in 2020, we have provided one of Japan’s most significant real estate-focused sales and contract support cloud services. In August, we started a partner program to collaborate with leading real estate service providers in the industry to accelerate DX through Open Innovation.

“Musubell” is steadily growing into one of the largest “DX engagement platforms for next-generation real estate transactions” in Japan and aims to become the de facto standard in the real estate industry representing Japan in the next few years. Furthermore, we will collaborate with business companies related to housing, insurance, and utility infrastructure loans to improve LTV over the long term.

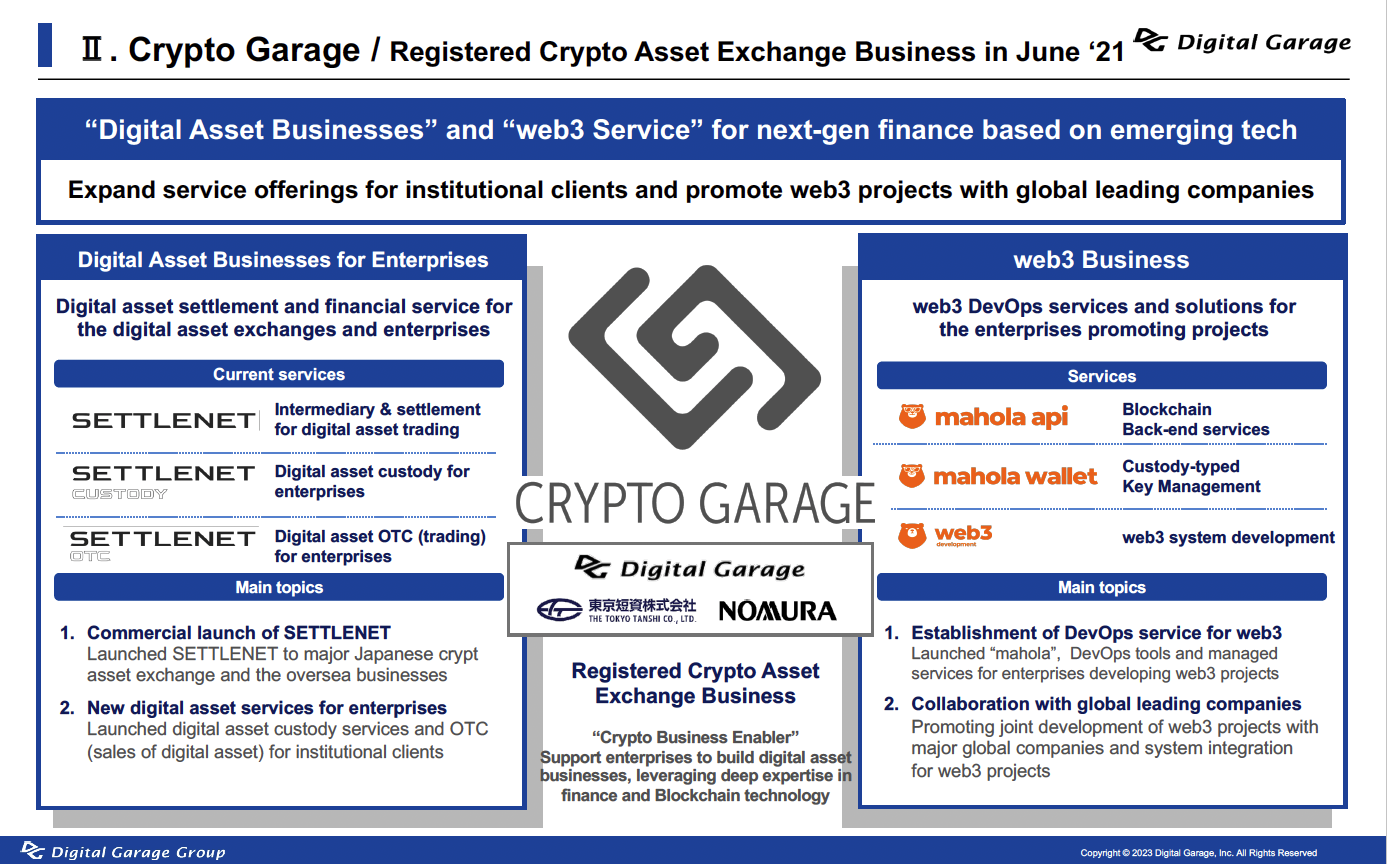

“Crypto Garage” is one of the focus businesses of [II]. “Crypto Garage” is a crypto asset exchange company offering corporate customers digital asset finance and web3 business. As we try to utilize this new technology in cooperation with web3, the LDP’s Headquarters for the Promotion of a Digital Society, the Bank of Japan, and the Financial Services Agency are working together to make web3 an essential part of the national strategy and leading globally. The enactment of the revised Payment Services Act on June 1 of this year, which defines stablecoins as an electronic payment method, is just one example.

We have received numerous inquiries from domestic global companies with customers and fans worldwide and companies with world-class IP assets such as manga and anime. “Crypto Garage” will be a medium to long-term initiative with a global perspective.

As for startup incubation efforts, “Open Network Lab (Onlab),” a pioneer of accelerator programs in Japan launched in 2010, was selected for the Tokyo Metropolitan Government’s “Be Smart Tokyo” project to foster the implementation of smart services. This has allowed us to build a robust support system for startups in industry, government, and academia.

Also, in Generative AI (Gen AI), we launched the STARTUP STUDIO “GenLab” based in the incubation center “DG717” in the U.S. DG717, the center of the web3 community in San Francisco, is also becoming the center of the entrepreneurial community when it comes to Gen AI. We will contribute to the next-generation Internet community while supporting Gen AI startups representing web3, Japan, and the U.S.

Furthermore, the co-founder of DG, Joi, has been appointed as the 14th president of the Chiba Institute of Technology (see press release). He will continue to serve as Director, Senior Managing Executive Officer, and Chief Architect of DG while enhancing collaboration between industry and academia. With DG717, we will also consider programs that will enable Japanese students to conduct R&D and start their businesses globally. Please see the next-generation technology areas and startup initiatives in the following slides.

The first quarter of the first year of the Medium-term Plan is off to a good start, and we will continue to collaborate and form alliances with various business partners. We will analyze technological advancements accurately and implement them in society continuously. Then, by incubating next-generation Internet businesses, we will expand the digital ecosystem and grow as a leading Japanese company that supports business growth and the next-generation IT ecosystem.

We look forward to your continued support and encouragement.