DG Mail

DG Mail is an e-mail magazine that provides you with the latest news from the Digital Garage Group.

If you would like to subscribe to DG Mail, please fill out the form.

Designing

New Context

Designing

New Context

Credit Card and PayPay Payments are Available with QR codes without Payment Devices and System Development

– DGFT, a subsidiary of DG and the payment services provider, launches “CloudPay Neo,” a device-free cashless payment service that does not require payment devices for business travel and in-home services, retail, and food businesses.

Japan’s cashless economy has been expanding with the cashless rate reaching 36% by 2022 and the number of payments increasing to 111 trillion yen*1. Cashless transactions benefit businesses with increased sales and operational efficiency as payment methods diversify. On the other hand, many small and medium-sized businesses (SMBs) hesitate to implement cashless payment systems due to costs such as payment fees and installation costs of payment devices*2.

Digital Garage, Inc. (TSE Prime section: 4819; HQ: Tokyo; Representative Director, President Executive Officer and Group CEO: Kaoru Hayashi; DG) has been providing a cashless payment service, “Cloud Pay,” since May 2019 to solve these issues, which enables the one-stop introduction and integrated management of multiple QR code payment services by simply installing a single QR code. Additionally, to meet businesses’ needs for easy access to various payment methods, including credit cards, DG Financial Technology, Inc. (HQ: Tokyo; Representative Director, President, Co-COO: Hiroshi Shino; DGFT) has decided to develop and offer “CloudPay Neo,” which further expands the functions of “Cloud Pay.”

https://www.veritrans.co.jp/payment/cloud-pay_neo.html

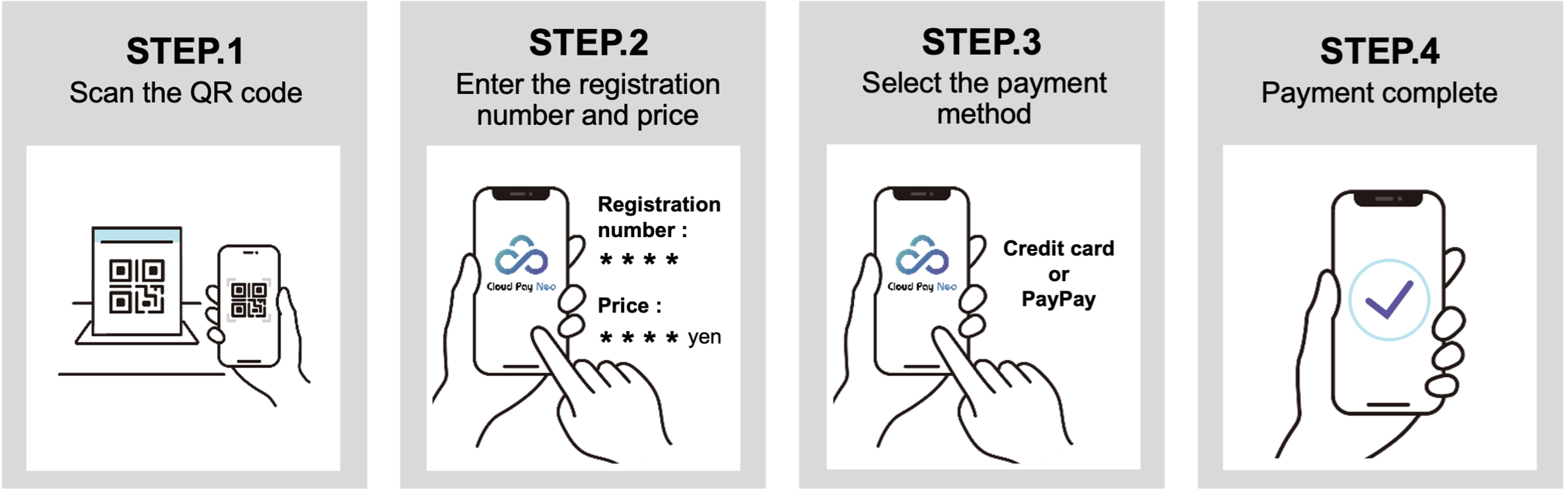

“CloudPay Neo” is a device-free cashless payment service that allows users to make credit card and various ID payments (account payments*3) by reading QR codes. The user reads the QR code with a smartphone, enters order information on the payment screen that appears, selects a payment method, and completes payment.

【Accepted payment methods】

Credit card (5 major brands) and PayPay

*Scheduled to accept d payment, au PAY, Rakuten Pay, Merpay, Apple Pay, Google Pay, UnionPay, and Alipay international payment in September 2023.

In addition to reducing costs related to the installation and security of payment devices, business operators can use the payment screens provided by DGFT, which allows them to quickly start implementing the payment system without the cost of system development. Also, DGFT handles all contracts with payment service providers and sales in one place, increasing the efficiency of business operations related to payment collection and management from introduction to the process.

This service is easy to install and portable, making it suitable for use in food, beverage, and retail outlets and in on-site and visiting services and events where staff visit customers’ homes and businesses to provide services and products. It can also be used as a backup in the event of a POS cash register failure or malfunction or a disaster or power outage. LIFE CARD Co., Ltd. has decided to introduce this service to its merchants as a service that meets business operators’ needs.

DGFT plans to add additional payment methods, support recurring payments, and make the payment screen multilingual (English and Chinese) to “CloudPay Neo” in September 2023. In order to meet the needs of both consumers and business operators, DG will continue to expand safe, secure, and convenient services and functions.

The DG Group promotes the “DG FinTech Shift,” a group strategy based on DGFT’s payment platform. DG will accelerate DX in Japan by providing a frictionless payment and financial services that facilitate the money flow.

【Process of using “CloudPay Neo”】

【About DG Financial Technology】

A payment provider that offers comprehensive payment services for e-commerce and other online businesses, stores, and offline interactions. Payments can be made at 950,000 locations (offline and online), with an annual processing volume exceeding 5.3 trillion yen (as of March 2023). In April 2021, the company name was changed to DG Financial Technology. As a core company of the DG Group’s “DG FinTech Shift,” DGFT supports businesses in their efforts to go cashless and promote DX from the payment and financial domains. Furthermore, it will continue to contribute to developing a sustainable society as a helpful infrastructure business by providing highly convenient functions and services to merchants and end-user consumers and offering secure and comfortable payment experience.

*1 Source: Ministry of Economy, Trade and Industry “2022 Ratio of Cashless Payment Among the Total Amount Paid by Consumers Calculated” (April 6, 2023)

*2 Source: Ministry of Economy, Trade and Industry “Reference material for the Study Group on Environmental Improvement for Further Widespread Promotion of Cashless Payments to Small and Medium-Sized Stores” (March 22, 2022)

*3 ID payment (account payment): It is a payment method that allows payment only by entering IDs and passwords registered with services such as PayPay and Rakuten, and payment is made using credit cards registered with the member ID or points or charge amounts.

※QR Code is a registered trademark of DENSO WAVE INCORPORATED.