DG Mail

DG Mail is an online magazine that provides you with the latest news from the Digital Garage Group.

If you would like to subscribe to DG Mail, please fill out the form.

Designing

New Context

Designing

New Context

Instant Gross Settlement Service for Trading Companies, Exchanges, Asset Managers and Brokers

Crypto Garage, Inc. (HQ: Tokyo; Representative Director: Masahito Okuma; Crypto Garage), a Fintech company developing blockchain financial services and also a subsidiary of Digital Garage, Inc. (TSE first section: 4819; HQ: Tokyo; Representative Director, President Executive Officer and Group CEO: Kaoru Hayashi; DG) launches the commercial services for “SETTLENET” (https://settlenet.io/), which is specialized in OTC settlement platform for trading companies, exchanges, asset managers and brokers in the crypto asset market.

Crypto Garage has been working with market participants and regulators on a demo version of “SETTLENET” under the Government of Japan’s regulatory sandbox scheme since January 2019. In this demo, we went beyond proof of concept using a test environment and succeeded in solving the problem of simultaneous settlement of actual digital assets and Japanese yen funds on a side chain, and completed our report to the Government of Japan in January 2020.

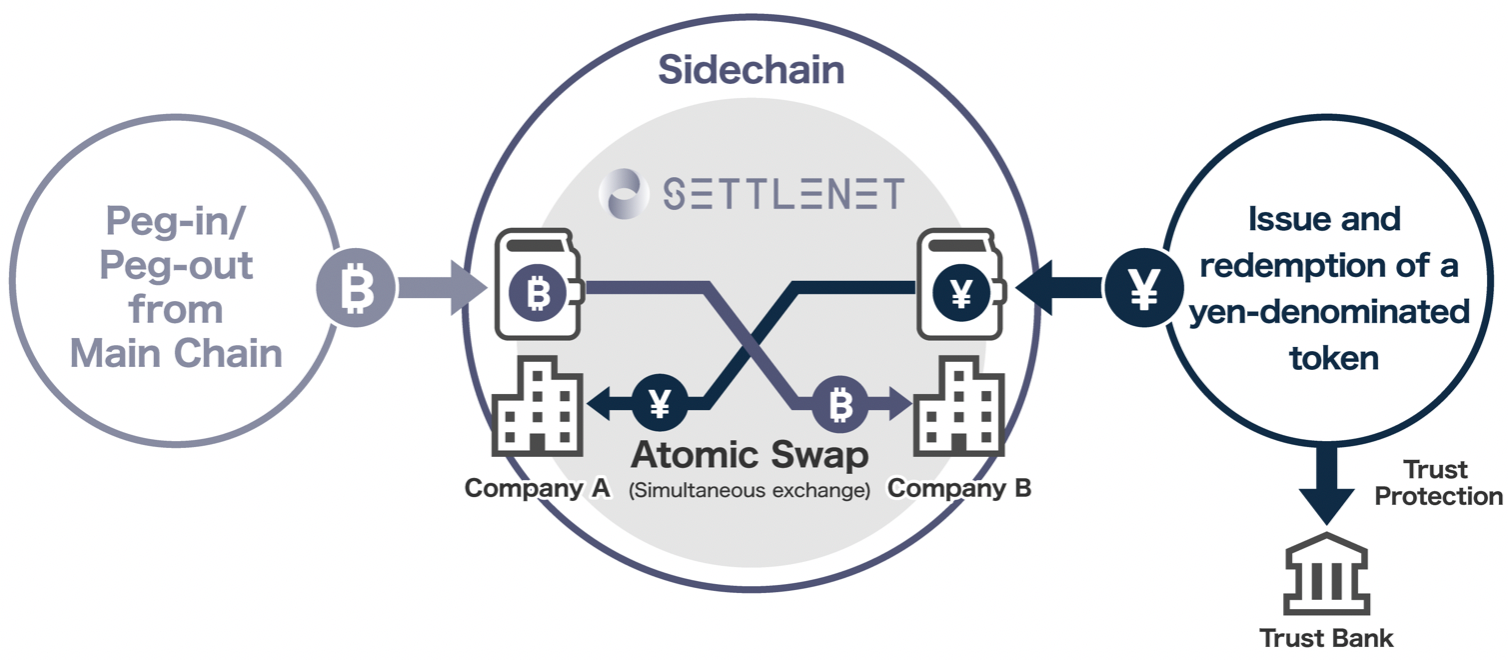

“SETTLENET” is based on the “Liquid Network,” a sidechain developed by Blockstream Corporation (HQ: Victoria, Canada; CEO: Adam Back), a company with world-leading technology and knowledge in the Bitcoin blockchain field, and gives the ability of a non custodial*1 based gross instant*2 DvP*3 settlement between digital tokens. Together with our settlement service, a yen-denominated token, “SETTLENET JPY (ticker symbol: JPYS),” is issued and can be used as a method of payment for the settling of digital assets between professional users with the aim to have a seamless fiat based settlement experience.

Normally, in the OTC crypto market, the delivery of the traded crypto asset and the fiat currency that is used for the settlement price of the crypto asset are carried out by separate means after the transaction is concluded, and settlement risk exists with the counterparty. Using a third party clearinghouse addresses such settlement risk, where the counterparties deposit assets to the clearinghouse for simultaneous delivery and settlement of the digital asset. This setup is extremely difficult to achieve a unified clearinghouse, where market participants around the world are equally trusted.

“SETTLENET” utilizes a simultaneous asset exchange protocol called atomic swap*4 on the “Liquid Network” to enable the simultaneous exchange of assets between trading parties without handing over control of the assets on the blockchain to a third party, within an average of two minutes after the transaction is executed. Participation in the platform not only reduces the risk of settlement with existing counterparties, but also enables them to expand their counterparties in a low-risk manner.

We also plan to provide the fundamental technologies and tools that have been accumulated through the development of the “SETTLENET.” As the first service to support the development of Liquid Network-related technologies and simplify the integration of “SETTLENET,” we will provide a commercial version of “UTXO Manager,” which facilitates the management of assets on the “Liquid Network.”

The “Liquid Network” already has a prominent U.S. dollar-denominated stable coin listed and most recently supports a Canadian dollar-denominated table coin. With asset-backed tokens, such as gold and other assets, are under consideration, the “Liquid Network” will continue to grow as a platform for issuing digital assets, and Crypto Garage will continue to contribute to the development of the digital markets and ecosystems by enabling the settlement of a variety of digital assets issued on the “Liquid Network.”

*1: Non-custodial means that users have control over the funds at all times without needing to deposit the asset to a third-party.

*2: “SETTLENET” allows for every transaction to be settled “instantly” and on a “gross” basis. This is different from “designated time net settlement,” which is a series of transactions over a given period that is settled on a net basis at a designated time.

*3: Abbreviation for Delivery versus Payment. The delivery of asset and the payment for the asset are done simultaneously. With “SETTLENET,” the risk of who pays or delivers the asset first is reduced.

*4: A technology that allows different types of cryptographic assets to be exchanged on a peer-to-peer basis without the need for a third party and without settlement counterparty risk.

【About the “Liquid Network”】

https://liquid.net/

The “Liquid Network” is a sidechain based on Bitcoin technology that allows for the fast, confidential and secure transfer of Bitcoin and various digital assets between companies. Since its launch in October 2018, the “Liquid Network” has 45 members, including cryptocurrency exchanges, market makers, brokers, financial operators and other crypto-asset-related companies around the world, with participants working in coalitions to manage and operate it to ensure that no single point of failure occurs.

【Reference】https://blockstream.com/2020/03/27/en-liquid-network-grows-to-45-members/

If you are interested, please inquire with us via the contact information below.

【Contact Information】info@cryptogarage.co.jp