DG Mail

DG Mail is an online magazine that provides you with the latest news from the Digital Garage Group.

If you would like to subscribe to DG Mail, please fill out the form.

Designing

New Context

Designing

New Context

Implementation to Improve Security and Streamline Payment Processing for au/UQ mobile

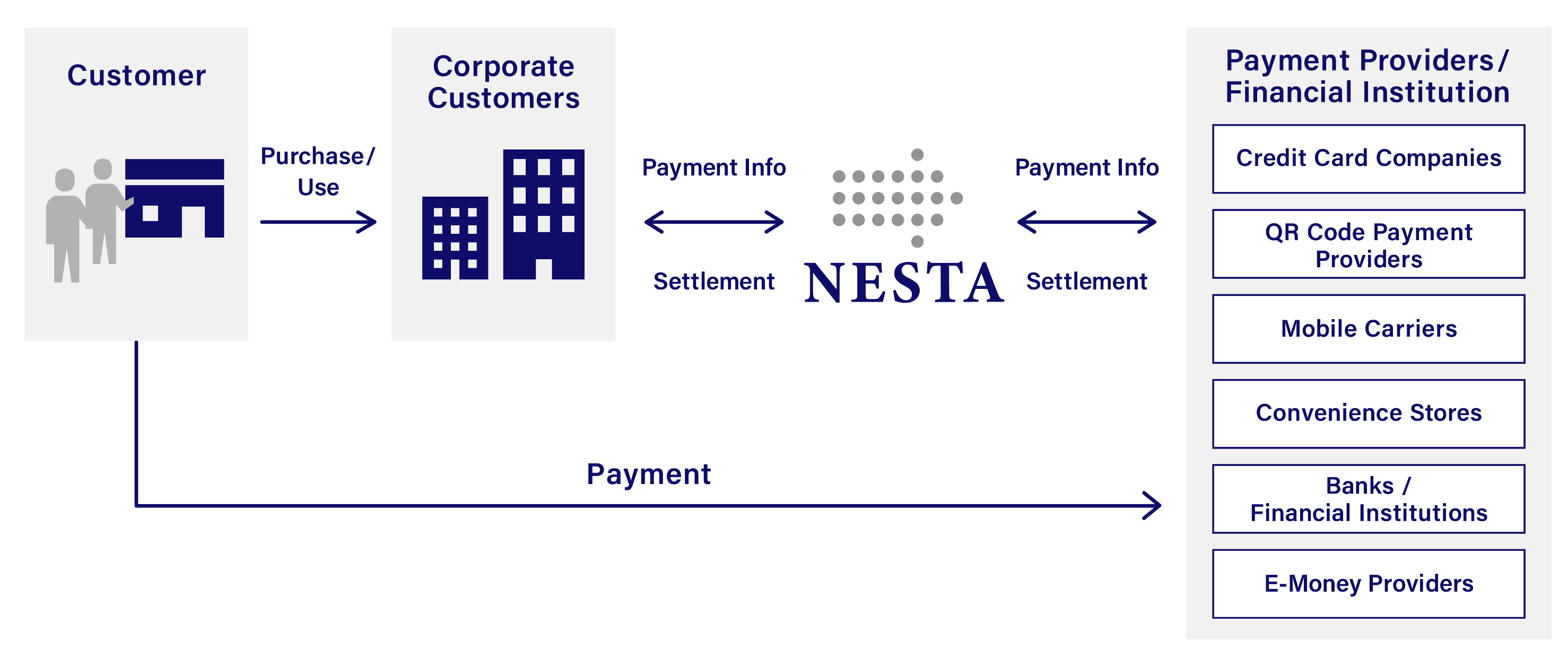

– DG Financial Technology, Inc. (HQ: Tokyo; Representative Director: Hiroshi Shino; DGFT), a subsidiary of Digital Garage, Inc. (TSE Prime section: 4819; HQ: Tokyo; Representative Director, President Executive Officer and Group CEO: Kaoru Hayashi; Digital Garage), which operates the Group’s payment business, is jointly developing a next-generation payment platform, “NESTA*1,” in collaboration with au Financial Service Corporation (HQ: Tokyo; Chief Executive Officer: Atsushi Nagano; au Financial Service).

– “NESTA” is set to be implemented in the payment processing system for au and UQ mobile telecommunications bills within 2025.

– This joint development is part of the business partnership agreement signed between DGFT and au Financial Service in May 2024.

“NESTA” is a secure payment platform jointly developed by DGFT and au Financial Service, built upon DGFT’s multi-payment system, “VeriTrans4G.” The platform complies with Japan’s highest security standards, supporting full tokenization and ensuring that card information is neither stored nor transmitted through the system, thereby mitigating the risk of data breaches. Its flexible and scalable architecture allows for smooth adaptation to future service enhancements and evolving security requirements, minimizing the burden on corporate users.

The first deployment will be within KDDI CORPORATION’s payment processing system for au and UQ mobile, where NESTA is expected to reduce the risk of information leaks and operational complexity associated with service expansion. This will contribute to improved security and greater operational efficiency in bill collection. Further expansion is also under consideration, including rollout to additional services within the KDDI Group and to external corporate customers.

*1 “NESTA” stands for “Next Standard” and reflects the goal of becoming a next-generation payment platform.

The trademark is currently under application by au Financial Service (Application No.: 2025-053937).

■Background of the Joint Development of the Next-Generation Payment Platform “NESTA”

KDDI Group is promoting its “Satellite Growth Strategy,” focusing on 5G communications, data-driven practices, and generative AI. This strategy aims to accelerate business growth by providing value-added services in focus areas such as digital transformation (DX), finance, and energy, while also exploring new growth opportunities in fields like mobility and healthcare.

As a strategic partner of DGFT, au Financial Service operates a unique credit model leveraging the KDDI Group’s diverse data assets. It plays a central role in promoting cashless payments within the Group, including issuing the “au PAY Card” (10.2 million members) and providing payment processing services that centrally manage credit card payments for telecommunications and other charges within the KDDI Group.

Against this backdrop, DGFT—a payment infrastructure provider supporting Japan’s cashless economy with over 1.19 million merchant locations and ¥7.5 trillion in annual transaction volume—has partnered with au Financial Service to jointly develop “NESTA.” Through this initiative, DGFT aims to leverage its payment platform to deliver secure and reliable payment services to merchants both within and beyond the KDDI Group.

■Key Features of “NESTA”

| Supports a wide variety of payment methods | Compatible with over 40 payment types, including credit cards, QR code payments, carrier billing, convenience store payments, bank transfers, Apple Pay, and Google Pay. |

|---|---|

| High-performance and stable data processing | ・ Utilizes a high-speed database also used by major financial institutions. ・ 2 high-performance data centers are operated in geographically separate locations to enable real-time, bidirectional data synchronization. ・ Even in the event of a system failure, uninterrupted operation is ensured with no downtime, supporting disaster response and business continuity (BCP). |

| Industry-leading security infrastructure | ・ Fully compliant with PCI DSS(Payment Card Industry Data Security Standard), the global security standard adopted by the 5 major international credit card brands. ・Ensures safe and reliable payment processing through a 24/7/365 monitoring system. |

■Strategic Role within the Group

Through co-creative partnerships such as the joint development of “NESTA” with au Financial Service, the Digital Garage Group aims to significantly expand DGFT’s payment transaction volume. The Group also seeks to increase its market share and enhance its industry positioning in the rapidly growing cashless payment market. Under the group strategy “DG FinTech Shift,” the Group will continue to accelerate growth by advancing collaborations with various strategic partners. At the same time, it remains committed to achieving the goals of its Medium-Term Plan ahead of schedule and contributing to the realization of a safe, secure, and convenient cashless society.

■About VeriTrans4G

“VeriTrans4G,” offered by DGFT, is a multi-payment service that supports a wide range of payment methods—among the largest in the industry—including credit cards, convenience store payments, bank transfers, e-money, QR code payments, and international transactions.

Its credit card payment service is built on a highly secure system that fully complies with tokenization requirements, ensuring that no card information is stored or transmitted. It comes standard with essential features such as recurring billing and automatic card information updates, as well as a variety of fraud prevention options.

URL: https://www.veritrans.co.jp/payment/

<Company Profile>

Name: DG Financial Technology, Inc.

Representative: Representative Director, President and Co-COO, Executive Officer and SEVP Hiroshi Shino

Head office: DG Bldg. 3-5-7 Ebisu Minami, Shibuya-ku, Tokyo

Date founded: April 1997

Business: DGFT provides various cashless payment solutions such as credit card, QR code, and others to more than 1 million online and offline locations of merchants across Japan. In addition to the payment service provider business, DGFT also provides e-commerce infrastructure, marketing tools, fraud detection solutions, and other services in collaboration with the Digital Garage Group and strategic partners to support various businesses in their efforts to go cashless and promote DX.

Registrations:

・Registered as an electronic payment agency or intermediary

・Registered fund transfer operator

・Registered business operator for handling credit card numbers and similar data

URL: https://www.dgft.jp/

Name: Digital Garage, Inc.

Representative: Representative Director, President Executive Officer and Group CEO Kaoru Hayashi

Head office address: DG Bldg., 3-5-7 Ebisu Minami, Shibuya-ku, Tokyo

Shibuya PARCO DG Bldg., 15-1 Udagawa-cho, Shibuya-ku, Tokyo

Date founded: August 1995

Business: Digital Garage’s corporate purpose is “Designing ‘New Context’ for a sustainable society with technology.” Digital Garage operates a payment business that provides one of the largest comprehensive payment platforms in Japan. In addition, DG has a marketing business that provides one-stop solutions in the digital and real world, and a startup investment and development business that reaches out to promising startups and technologies in Japan and overseas.

URL: https://www.garage.co.jp/en/

※ Apple Pay is a trademark of Apple Inc., registered in the U.S. and other countries. TM and © Apple Inc. All rights reserved.

※ All other company names, product names, and service names mentioned herein are trademarks or registered trademarks of their respective owners.