DG Mail

DG Mail is an online magazine that provides you with the latest news from the Digital Garage Group.

If you would like to subscribe to DG Mail, please fill out the form.

Designing

New Context

Designing

New Context

Providing users with an unprecedented cash payment experience by easily, securely and smartly connecting with compact automatic payment machines in stores to support unmanned operations

– DG Financial Technology, Inc. (DGFT), a subsidiary of Digital Garage, Inc. (Digital Garage) announces the launch of initiatives for collaboration between “ARUNAS AES-CUT” compact automatic payment machines manufactured by AKATSUKI ELECTRIC MFG. Co., Ltd. (HQ: Shiga; Representative Director and President: Masato Sugiyama; “AKATSUKI ELECTRIC MFG.”), and our O2O terminal-free payment service “Cloud Pay REGI.”

With the introduction of cashless systems across a wide range of industries including SMEs in recent years, as well as the use of “online customer service solutions” that provide non-face-to-face customer service and the growing interest in labor-saving operations, there has been a growing trend toward achieving greater operational efficiency and labor savings in all industries.

Meanwhile, there are certain types of businesses with high cash payment requirements, with many businesses struggling to achieve a balance between cashless and cash services.

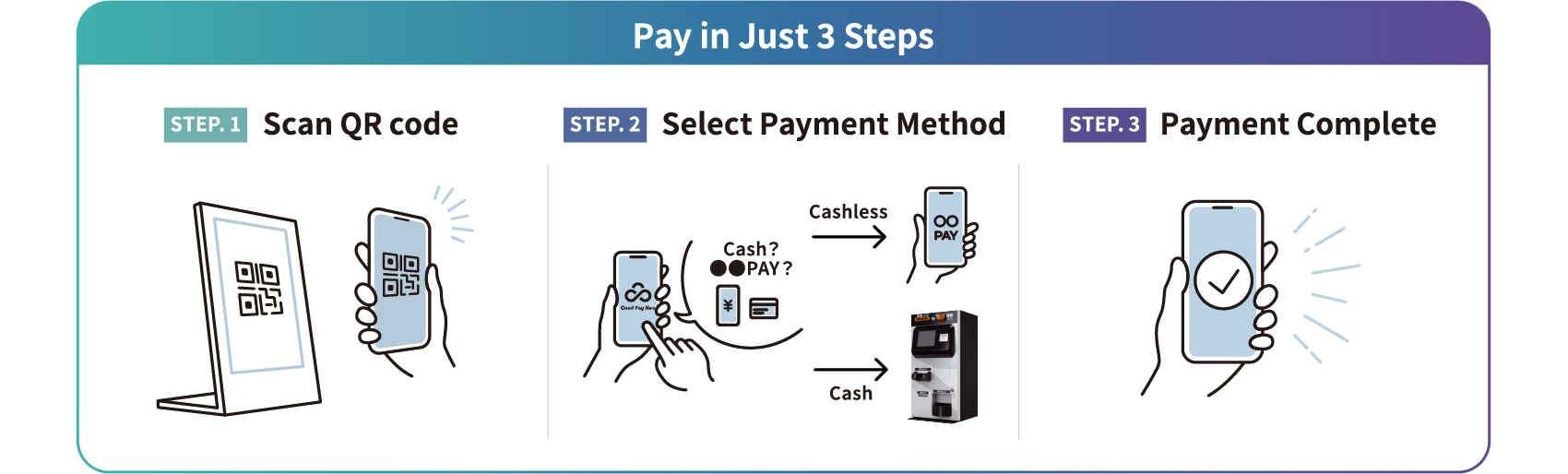

With this collaboration, users will be able to use their own smartphones to scan “Cloud Pay REGI” QR codes displayed in stores and on online screens, etc., and select either “cashless” or “cash” as their payment method. Cashless payments are completed entirely on the user’s smartphone, eliminating the need for a dedicated payment terminal or cash register. When users select cash, “ARUNAS AES-CUT” can still be used for cash payments using payment machines.

Given that payment data, including for cash payments, can be managed centrally in “Cloud Pay REGI,” it can be used to examine usage or other trends that had been difficult to visualize in the past.

* Further details about this solution will be announced as soon as the official launch of the service has been finalized.

■Background and the Objective of the Initiative

The number of automatic payment machines installed*1 at restaurants, government offices, and educational institutions has grown in recent years, and the types of labor-saving and unmanned operations are advancing in a range of industries.

On the other hand, conventional automatic payment machines are often large and expensive, resulting in a heavy burden on businesses in terms of installation and operation costs as well as installation space.

The following issues have also become evident when payment machines are equipped with cashless payment functions.

・ Increased equipment costs and administrative load caused by the main payment machine and payment terminals

・ Poor user experience with different steps and flow processes required for each type of payment method

・ Increased complexity of management work for integrating systems from multiple vendors

In light of this situation, AKATSUKI ELECTRIC MFG. and DGFT will work on linking small payment machines and “Cloud Pay REGI” as a means of providing flexible payment options while reducing the operational workload on businesses. With this approach, a seamless payment experience will be provided for both online and offline services, from cashless payment to cash payments using cash registers, with the aim of contributing to the smooth rollout of cashless payments and promoting DX across a broad range of businesses.

*1 Yano Research Institute Ltd., “Survey on the POS Terminal Market (2024),” press release, October 16, 2024.

■Comments

Hiroshi Shino (DG Financial Technology, Representative Director, President and Co-COO)

Small businesses make up about 70% of the retail industry in Japan, and among them, local restaurants, barbers and beauty shops, and relaxation salons are finding it challenging to move away from cash as a means of payment. As a service capable of addressing such requirements, “Cloud Pay REGI” provides a new payment experience by facilitating the transition to cashless payments while also retaining cash payments. It will continue catering to increasingly diversifying needs and provide safe, secure and convenient services, while also contributing to an enhanced user experience and promoting DX in Japan.

■Main features

<About Cloud Pay REGI>

“Cloud Pay REGI” is part of DGFT’s “Cloud Pay” series of cashless payment services. Built on the “Cloud Pay Neo” platform—which allows users to select from a wide range of payment methods, including credit cards and various QR code payments, simply by scanning a universal QR code with their smartphones—Cloud Pay REGI further enhances flexibility at the point of payment.

For more information about Cloud Pay Neo, please visit: https://www.veritrans.co.jp/lp/cloudpayneo/ (Only in Japanese)

By integrating with automated checkout machines and other cash payment devices, Cloud Pay REGI enables users to choose not only cashless options, but also cash payments.

For stores and merchants, Cloud Pay REGI provides unified management of both cashless and cash transactions, supporting labor savings and operational efficiency.

*Please note that prior screening is required to use certain payment services.

<About ARUNAS AES-CUT>

“ARUNAS AES-CUT” developed by AKATSUKI ELECTRIC MFG. is a compact, next-generation payment machine that combines semi-self payment and touch-operated ticketing functions. With the smallest size in the industry, it can be installed almost anywhere, allowing for efficient payments at salons and restaurants.

Cashless payments are completed with “Cloud Pay REGI,” eliminating the need for a physical terminal other than a payment machine. It is a hybrid system that utilizes the payment machine only for cash payments, achieving a balance between both “on-site DX” and “user needs for those preferring cash”.

(1) All your cashless payments with just a smartphone

Cashless payments are completed with “Cloud Pay REGI.” This provides a one-stop, non-face-to-face, contactless payment experience without having to rely on POS registers or payment terminals.

(2) Smooth, labor-saving payment experience for cash payments

Users who prefer paying with cash are able to use the payment machine. This allows for hybrid cash and cashless operations.

(3) Centralized management of payment data, including “cash trends”

Information related to cash payments can also be managed centrally with “Cloud Pay REGI,” making it possible to visualize cash transactions that were difficult to identify in the past. Data can be utilized to improve marketing and operations, including information on selection trends for payment types and usage timing.

(4) Reduction in terminal costs and operational workload

No need to install and maintain external payment terminals means initial costs and maintenance and operational workloads are significantly reduced. No additional cost are incurred for implementing multiple cashless payment methods.

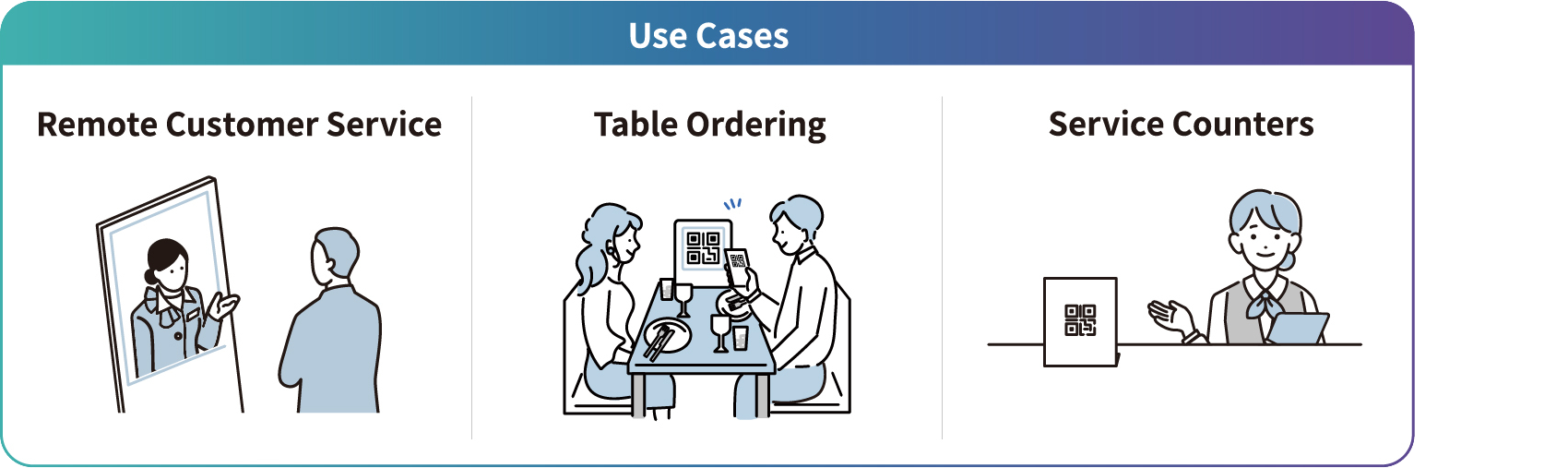

■Utilization scenarios

(1) Hotel check-in counter and car rental reception (online customer service)

・ After completing customer service, a payment QR code is displayed on the screen for the user

・ Payment options are available through payment machines or “Cloud Pay REGI”

・ Clear distinction between customer service and accounting roles, which boosts operational efficiency

(2) Restaurants (ordering at the table)

・ Cashless payment allows for “cash register-free” payments without any human interaction, from ordering to payments

・ Helps to increase turnover efficiency during busy periods, eliminate waiting times for cash registers, and achieve labor savings

With the “PIN bypass*2” (skip PIN function) eliminated in principle for credit card payments effective from March 2025 and the increasing challenges in using conventional PIN pads to enter PINs or use signatures, terminal-less payment services like “Cloud Pay REGI” are an effective option when it comes to boosting operational efficiency at restaurants.

*2 PIN bypass: A procedure that eliminates the need to enter a PIN code for credit card payments, instead verifying the identity of the customer with their signature. This procedure is positioned as a measure in certain unavoidable cases, such as when a user forgets their PIN when making a payment.

Source: Japan Credit Card Association, “Proper Handling of IC Credit Cards“

(3) Educational institutions and public facilities (counter services)

・ Supports payments for issuing certificates, teaching materials, course fees, etc.

・ Allows payments to be made at night and out of office hours

・ Reduces workload of staff and ensures user convenience

■For the Future

Going forward, AKATSUKI ELECTRIC MFG. and DGFT will continue working together to reduce the workload on businesses facing payment issues and provide a smooth payment experience that does not confuse users. Solutions will continue being provided to cater to the specific design requirements of each business, expanding availability to meet the growing need for self-service payment at a broad range of customer service sites, such as placing orders at tables at restaurants, hotels, car rental agencies, and various counter services.

For commercial adoption into the future, we will further expand functionality and strengthen the installation support system, while examining the feasibility of additional functions.

■Exhibit Details

This collaborative solution can be seen in operation at the AKATSUKI ELECTRIC MFG. exhibition booth at the 5th RETAILTECH OSAKA 2025 held on July 10 (Thr) and 11 (Fri), 2025.

Visit the booth to see a demonstration with actual payment machines and “Cloud Pay REGI” in operation.

Name: 5th RETAILTECH OSAKA 2025

Dates: July 10 (Thur) to July 11 (Fri), 2025

Venue: INTEX Osaka, Hall 5

Booth Number: RT07

Organizers: Nikkei Inc., Television Osaka, Inc.

Official website: https://messe.nikkei.co.jp/rs/ (Only in Japanese)

* Advanced registration required

■Company Profile

Name: Akatsuki Electric MFG. Co., Ltd.

Representative Director and President: Masato Sugiyama

Headquarters/Factory: 281-1 Yamadera-cho, Kusatsu-shi, Shiga, Japan

Foundation: May 1969

Business outline: Planning, development, design, production and sales of

microelectronics/microcomputer-applied systems and system devices.

AKATSUKI ELECTRIC MFG. is a manufacturer that was established more than 55 years ago, and is involved in cash-handling machines such as e-money charge machines, automatic payment machines and automatic foreign currency exchange machines. Under the “ARUNAS” brand, it supplies products of high quality and reliability, and contributes to enhancing convenience throughout society.

URL:https://arunas.co.jp/en/

Name: DG Financial Technology, Inc.

Representative: Representative Director, President and Co-COO, Executive Officer and SEVP Hiroshi Shino

Head office: DG Bldg. 3-5-7 Ebisu Minami, Shibuya-ku, Tokyo

Date founded: April 1997

Business: DGFT provides various cashless payment solutions such as credit card, QR code, and others to more than 1 million online and offline locations of merchants across Japan. In addition to the payment service provider business, DGFT also provides e-commerce infrastructure, marketing tools, fraud detection solutions, and other services in collaboration with the Digital Garage Group and strategic partners to support various businesses in their efforts to go cashless and promote DX.

Registrations:

・Registered as an electronic payment agency or intermediary

・Registered fund transfer operator

・Registered business operator for handling credit card numbers and similar data

URL: https://www.dgft.jp/

Name: Digital Garage, Inc.

Representative: Representative Director, President Executive Officer and Group CEO Kaoru Hayashi

Head office address: DG Bldg., 3-5-7 Ebisu Minami, Shibuya-ku, Tokyo

Shibuya PARCO DG Bldg., 15-1 Udagawa-cho, Shibuya-ku, Tokyo

Date founded: August 1995

Business: Digital Garage’s corporate purpose is “Designing ‘New Context’ for a sustainable society with technology.” Digital Garage operates a payment business that provides one of the largest comprehensive payment platforms in Japan. In addition, Digital Garage has a marketing business that provides one-stop solutions in the digital and real world, and a startup investment and development business that reaches out to promising startups and technologies in Japan and overseas.

URL: https://www.garage.co.jp/en/

※All other company names, product names, and service names mentioned herein are trademarks or registered trademarks of their respective owners.