2022.12.15

DG Financial Technology Begins Offering “Bank Pay,” a Bank Account-linked Payment Service, to E-Commerce and App Business Operators

~Directly Pay and Recharge from Accounts at Financial Institutions Including City Banks, Regional Banks, and Credit Unions~

– DG Financial Technology, Inc. (DGFT), a payment service provider and a subsidiary of Digital Garage, Inc. (DG), will begin offering “Bank Pay,” a payment service from the Japan Electronic Payment Promotion Organization, as a payment option in its “VeriTrans4G,” comprehensive payment service, starting from January 2023.

■ Overview of “Bank Pay”

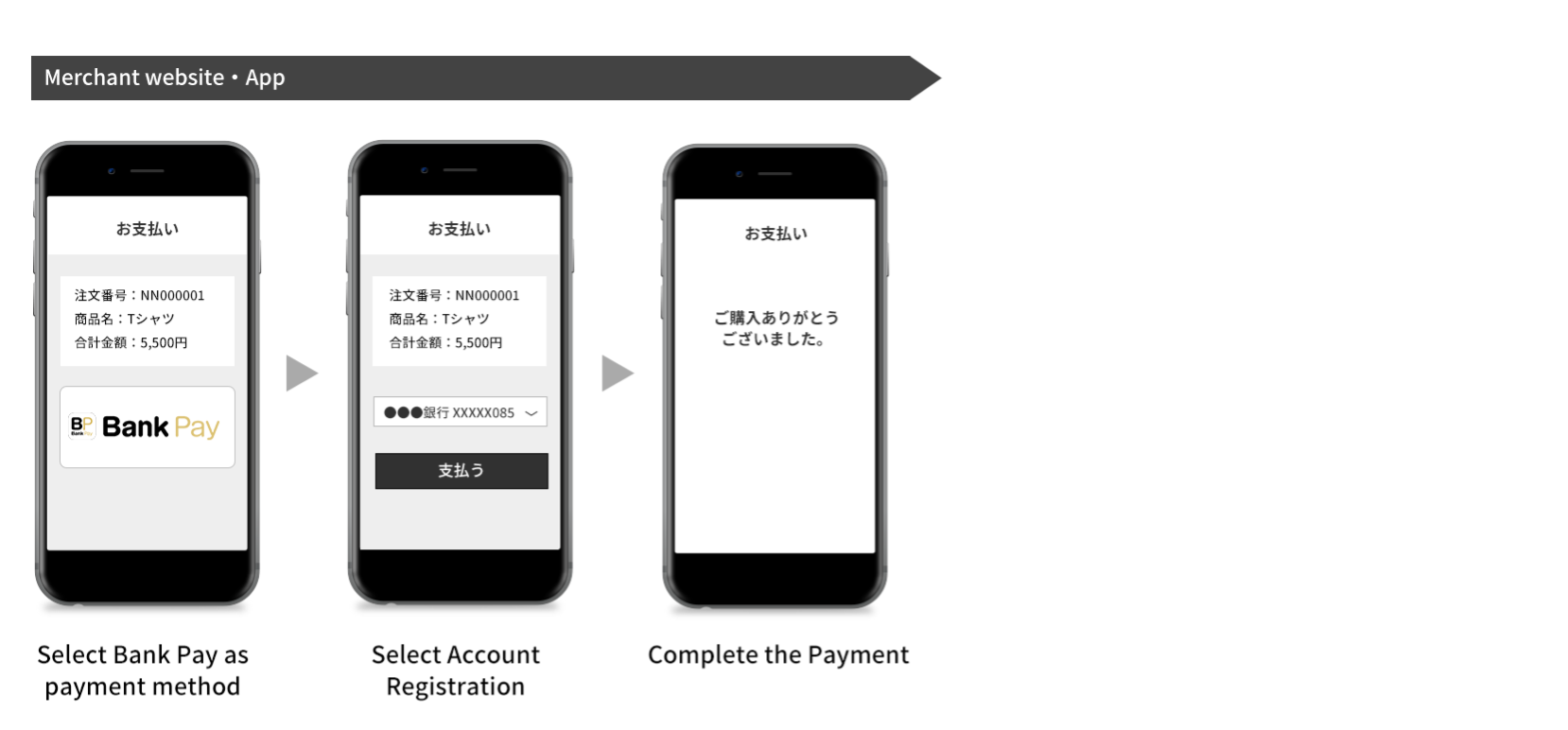

With “Bank Pay,” users can make payments and recharge directly from their financial institution account registered in advance. This service is available for financial institutions*1 across Japan linked with “Bank Pay,” including regional banks, credit unions, and city banks like Sumitomo Mitsui Banking Corporation, Mizuho Bank, MUFG Bank, and Resona Bank. Users register their financial institution account during the initial procedures. After that, they can select the account to complete a withdrawal for recharges and payments on E-Commerce websites or apps. They can also register and select financial institution accounts for different services and use them for different purposes. In addition to paying for individual purchases, “Bank Pay” supports recurring charges, such as regular purchases and subscription services.*2

Among Japanese adults, 98%*3 have financial institution accounts. By implementing this service, E-Commerce and app business operators can reach these consumers as new customers. “Bank Pay” provides a simple payment process with no need to input bank account information for each transaction, which helps to prevent churn on the payment screen and increase the rate of repeat customers. “Bank Pay” can also be used for recharging—including business operators’ own electronic money—and payments for E-Commerce websites, online services, and apps.

■ “VeriTrans4G” comprehensive payment service

“VeriTrans4G” is a comprehensive payment solution compatible with the most significant number of payment methods in the industry, including not only basic payment methods using credit cards, convenience stores, and banks; but also e-money; carrier payments; various ID-based payment methods such as PayPay; and international payment methods such as UnionPay, Alipay, and PayPal. Flexible, expandable systems are built to minimize difficulties faced by business operators when adding new payment methods and security requirements. Business operators who use “VeriTrans4G” can easily implement “Bank Pay” just by applying, without having to conclude individual contracts or carry out system integration with financial institutions. Transaction information can be consolidated on the management screen. Also, they can calculate funds received and transfer money together with deposits from other payment methods, which reduces the operational burden for adding payment methods.

“VeriTrans4G” also offers large-volume payment processing and a high operating rate with payment infrastructure at two data centers implementing the advanced database from Oracle, which is also used by international financial institutions. Since the company’s establishment it has built stable payment systems and operating structures with advanced security environments to make it possible for merchants to retain no card information. It was also the first Japanese company to earn PCI DSS certification.

■ Future developments

As a payment service supporting all banks, “Bank Pay” plans to increase its number of financial institutions in the future. DGFT will expand its integration with these financial institutions and enhance “VeriTrans4G” service going forward, with the aim of making it possible for business operators to introduce new payment services with less cost and difficulty.

Based on its “DG FinTech Shift,” a Group strategy that integrates payments and data, the DG Group will create new financial DX services centered on the payment business, including next-generation payments and Fintech marketing services.

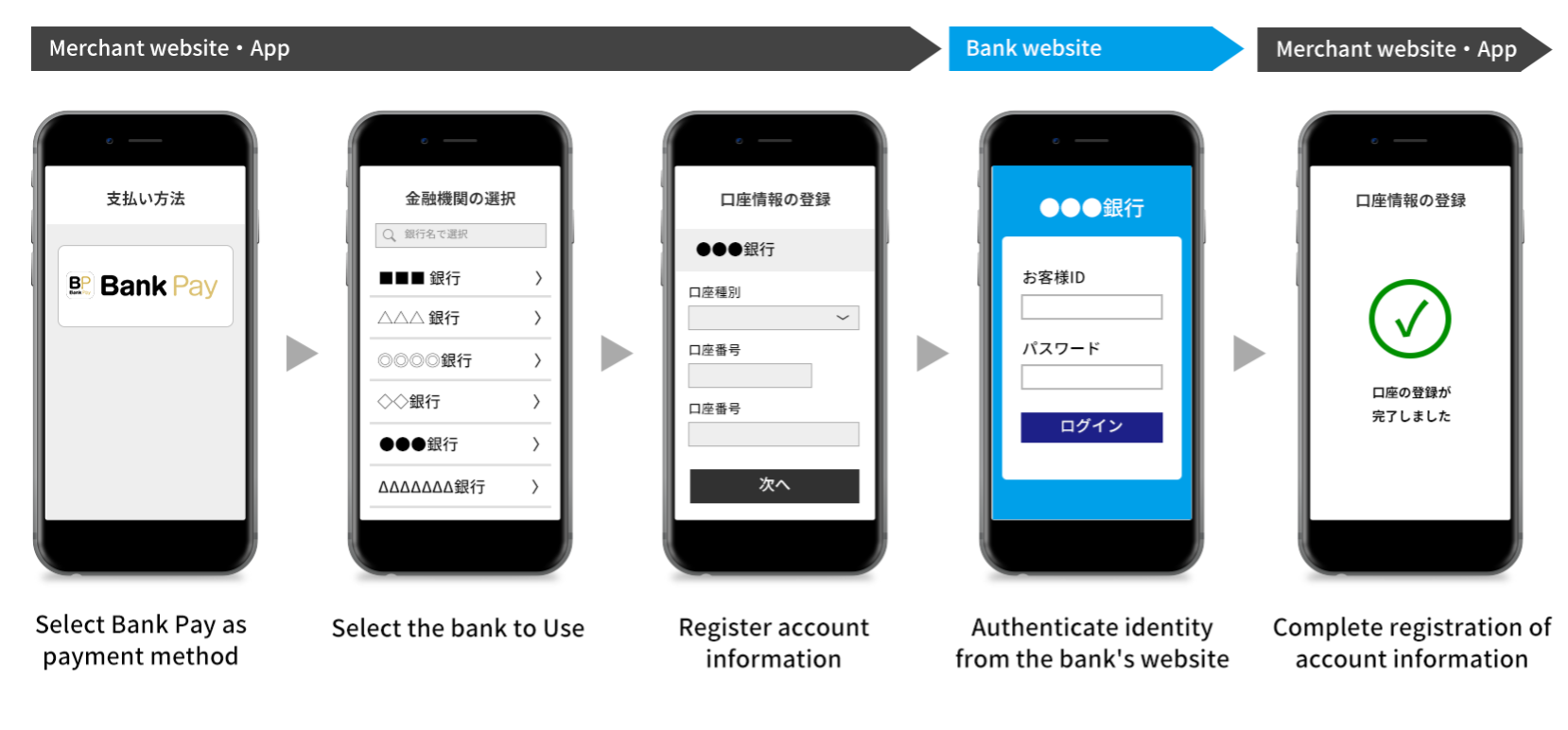

【Account registration process】

【Payment process】

【About DG Financial Technology】https://www.dgft.jp/

A payment provider that offers comprehensive payment services for E-Commerce and other online businesses, stores, and offline interactions. Payments can be made at 880,000 locations (offline and online), with an annual processing volume exceeding 4.8 trillion yen (as of September 2022). In April 2021, the company name was changed to DG Financial Technology. As a core company of the DG Group’s “DG FinTech Shift,” DGFT supports businesses in their efforts to go cashless and promote DX from the payment and financial domains. Furthermore, we will continue to contribute to developing a sustainable society as a helpful infrastructure business by providing highly convenient functions and services to merchants and end-user consumers and offering secure and comfortable payment experience.

*1: Forty-three banks will be available when the service is launched on “VeriTrans4G.”

*2: Service availability varies depending on the financial institution.

*3: Source Percent of Japanese adults with bank accounts. World Bank’s “The Global Findex Database 2021” (June 2022)